GST Registration for Individuals with our Beginner Plan will cover most of your basic requirements

- Completion of Registration process

- Provide Registration Certificate

GST Registration for Individuals with our Beginner Plan will cover most of your basic requirements

GST is a single uniform indirect tax which was introduced to replace Central and State indirect taxes such as VAT, CENVAT, and others. GST applies on all types of businesses, small or large. This makes it one of the greatest tax reforms in the country. The entire nation will follow a unified tax structure. As the name suggests, GST will be applicable on both goods and services and India will follow a dual system of GST to keep both the Centre and State independent of each other. The GST council will be headed by the Union Finance Minister and it will consist of various State Finance Ministers. GST will be devised as a four-tiered tax structure with tax slabs of 5%, 12%, 18%, and 28% for various different categories of products and services. 0% rate is kept for most essential goods such as rice, wheat.

Designed as a uniformed tax for the entire nation, it will replace the following indirect taxes earlier levied by the Centre and the State- (i) Taxes levied and collected by the Centre: a. Central Excise duty b. Additional Duties of Customs (commonly known as CVD) c. Special Additional Duty of Customs (SAD) d. Service Tax AND (ii) Taxes levied and collected by the State: a. State VAT b. Central Sales Tax c. Entertainment and Amusement Tax (except when levied by the local bodies) d. Taxes on lotteries, betting and gambling.

Hailed as one of the biggest tax reforms of the country, the Goods and Services Tax (GST) subsumes many indirect taxes which were imposed by Centre and State such as excise, VAT, and service tax. It is levied on both goods and services sold in the country

Any reform is bound to have advantages and disadvantages. In this article, we will talk about the advantages of GST:

Advantages of GST

GST is a comprehensive indirect tax that was designed to bring the indirect taxation under one umbrella. More importantly, it is going to eliminate the cascading effect of tax that was evident earlier.

Cascading tax effect can be best described as ‘Tax on Tax’. Let us take this example to understand what Tax on Tax is:

Before GST regime:

A consultant offering services for say, Rs 50,000 and charged a service tax of 15% (Rs 50,000 * 15% = Rs 7,500).

Then say, he would buy office supplies for Rs. 20,000 paying 5% as VAT (Rs 20,000 *5% = Rs 1,000).

He had to pay Rs 7,500 output service tax without getting any deduction of Rs 1,000 VAT already paid on stationery.

His total outflow is Rs 8,500.

Under GST

| GST on service of Rs 50,000 @18% | 9,000 |

| Less: GST on office supplies (Rs 20,000*5%) | 1,000 |

| Net GST to pay | 8,000 |

Earlier, in the VAT structure, any business with a turnover of more than Rs 5 lakh (in most states) was liable to pay VAT. Please note that this limit differed state-wise. Also, service tax was exempted for service providers with a turnover of less than Rs 10 lakh.

Under GST regime, however, this threshold has been increased to Rs 20 lakh, which exempts many small traders and service providers.

Let us look at this table below:

| Tax | Threshold Limits |

| Excise | 1.5 crores |

| VAT | 5 lakhs in most states |

| Service Tax | 10 lakhs |

| GST | 20 lakhs (10 lakhs for NE states) |

Under GST, small businesses (with a turnover of Rs 20 to 75 lakh) can benefit as it gives an option to lower taxes by utilizing the Composition scheme. This move has brought down the tax and compliance burden on many small businesses.

The entire process of GST (from registration to filing returns) is made online, and it is super simple. This has been beneficial for start-ups especially, as they do not have to run from pillar to post to get different registrations such as VAT, excise, and service tax.

Earlier, there was VAT and service tax, each of which had their own returns and compliances. Below table shows the same:

Under GST, however, there is just one, unified return to be filed. Therefore, the number of returns to be filed has come down. There are about 11 returns under GST, out of which 4 are basic returns which apply to all taxable persons under GST. The main GSTR-1 is manually populated and GSTR-2 and GSTR-3 will be auto-populated.

Earlier to GST regime, supplying goods through e-commerce sector was not defined. It had variable VAT laws. Let us look at this example:

Online websites (like Flipkart and Amazon) delivering to Uttar Pradesh had to file a VAT declaration and mention the registration number of the delivery truck. Tax authorities could sometimes seize goods if the documents were not produced.

Again, these e-commerce brands were treated as facilitators or mediators by states like Kerala, Rajasthan, and West Bengal which did not require them to register for VAT.

All these differential treatments and confusing compliances have been removed under GST. For the first time, GST has clearly mapped out the provisions applicable to the e-commerce sector and since these are applicable all over India, there should be no complication regarding the inter-state movement of goods anymore.

Read a more detailed analysis of the impact of GST on e-commerce.

Earlier, the logistics industry in India had to maintain multiple warehouses across states to avoid the current CST and state entry taxes on inter-state movement. These warehouses were forced to operate below their capacity, giving room to increased operating costs.

Under GST, however, these restrictions on inter-state movement of goods have been lessened.

As an outcome of GST, warehouse operators and e-commerce aggregators players have shown interest in setting up their warehouses at strategic locations such as Nagpur (which is the zero-mile city of India), instead of every other city on their delivery route.

Reduction in unnecessary logistics costs is already increasing profits for businesses involved in the supply of goods through transportation.

Visit here to read more about the impact of GST on logistics.

In the pre-GST era, it was often seen that certain industries in India like construction and textile were largely unregulated and unorganized.

Under GST, however, there are provisions for online compliances and payments, and for availing of input credit only when the supplier has accepted the amount. This has brought in accountability and regulation to these industries.

Let us now look at disadvantages of GST. Please note that businesses need to overcome these disadvantages to run the business smoothly.

Any reform is bound to have advantages and disadvantages. In this article, we will talk about the disadvantages of GST:

Disadvantages of GST

Businesses have to either update their existing accounting or ERP software to GST-compliant one or buy GST software so that they can keep their business going. But both the options lead to increased cost of software purchase and training of employees for an efficient utilization of the new billing software.

Small and medium-sized enterprises (SME) who have not yet signed for GST have to quickly grasp the nuances of the GST tax regime. They will have to issue GST-complaint invoices, be compliant to digital record-keeping, and of course, file timely returns. This means that the GST-complaint invoice issued must have mandatory details such as GSTIN, place of supply, HSN codes, and others.

As we have already established that GST is changing the way how tax is paid, businesses will now have to employ tax professionals to be GST-complaint. This will gradually increase costs for small businesses as they will have to bear the additional cost of hiring experts.

Also, businesses will need to train their employees in GST compliance, further increasing their overhead expenses.

As GST was implemented on the 1st of July 2017, businesses followed the old tax structure for the first 3 months (April, May, and June), and GST for the rest of the financial year.

Businesses may find it hard to get adjusted to the new tax regime, and some of them are running these tax systems parallelly, resulting in confusion and compliance issues.

Unlike earlier, businesses are now switching from pen and paper invoicing and filing to online return filing and making payments. This might be tough for some smaller businesses to adapt to.

Smaller businesses, especially in the manufacturing sector will face difficulties under GST. Earlier, only businesses whose turnover exceeded Rs 1.5 crore had to pay excise duty. But now any business whose turnover exceeds Rs 20 lakh will have to pay GST.

However, SMEs with a turnover upto Rs 75 lakh can opt for the composition scheme and pay only 1% tax on turnover in lieu of GST and enjoy lesser compliances. The catch though is these businesses will then not be able to claim any input tax credit. The decision to choose between higher taxes or the composition scheme (and thereby no ITC) will be a tough one for many SMEs.

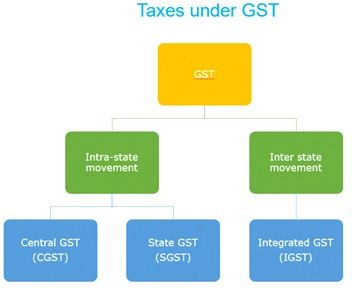

CGST: Under GST, CGST is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by the CGST Act. SGST will also be levied on the same Intra State supply but will be governed by the State Government.

This implies that both the Central and the State governments will agree on combining their levies with an appropriate proportion for revenue sharing between them. However, it is clearly mentioned in Section 8 of the GST Act that the taxes be levied on all Intra-State supplies of goods and/or services but the rate of tax shall not be exceeding 14%, each.

SGST: Under GST, SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST Act. As explained above, CGST will also be levied on the same Intra State supply but will be governed by the Central Government.

Note: Any tax liability obtained under SGST can be set off against SGST or IGST input tax credit only.

IGST: IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST will be applicable on any supply of goods and/or services in both cases of import into India and export from India.

Note: Under IGST,

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes. Both the Governments have distinct responsibilities to perform, as per the Constitution, for which they need to raise tax revenue.

The Centre and States are simultaneously levying GST.

The three types tax structure is implemented to help taxpayers take the credit against each other, thus ensuring “One Nation, One Tax”.

In the GST Regime, businesses whose turnover exceeds Rs. 40 lakhs* (Rs 10 lakhs for NE and hill states) is required to register as a normal taxable person. This process of registration is called GST registration.

For certain businesses, registration under GST is mandatory. If the organization carries on business without registering under GST, it will be an offence under GST and heavy penalties will apply.

GST registration usually takes between 2-6 working days. We’ll help you to register for GST, check our GST services for more information.

All businesses that successfully register under GST are assigned a unique Goods and Services Tax Identification Number also known as GSTIN.

If a business operates from more than one state, then a separate GST registration is required for each state. For instance, If a sweet vendor sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and TN respectively.

A business with multiple business verticals in a state may obtain a separate registration for each business vertical.

Small businesses having an annual turnover less than Rs. 1.5 crore** ( Rs. 75 Lakhs for NE States) can opt for Composition scheme.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019.

Composition dealers will pay nominal tax rates based on the type of business:

Composition scheme is not applicable to:

This scheme is a lucrative option for all SMEs who want lower compliance and lower rates of taxes under GST.

A GST taxpayer whose turnover is below Rs 1.5 crore** can opt for Composition Scheme. In case of North-Eastern states and Himachal Pradesh, the present limit is Rs 75 lakh.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover.

**CBIC has notified the increased in the threshold turnover for opting into the Composition Scheme from Rs 1 crore to Rs 1.5 crores. The notification will be effective from 1st April 2019. Learn the Rules about Composition scheme & Know the pros & cons of being a composition dealer.

Obtain GST registration and file CMP-02 to opt-in for the scheme.

As the name suggests, anyone can register under GST even though he may not be required by law

For whom is voluntary registration available?

Certain businesses are required to register mandatorily under GST such as

Small businesses with turnover less than 20lakhs can voluntarily register under GST.

Businesses with turnover 20 lakhs to 1 crore can opt for composition levy. But composition levy comes with additional disadvantages such as not being able to collect any tax from their customers or avail input tax credit. Such SMEs may also opt for to register themselves as normal dealers instead of composition dealers.

Example:

A small grocery dealer with a turnover of Rs. 12-15 lakh is not be required to register under GST. However, he is also supplying to a nearby restaurant which is registered under GST (having a turnover exceeding Rs. 20 lakh) The restaurant is eligible for input credit and may look for a registered seller who can pass on ITC . In such a scenario, the grocer might register voluntarily to pass on the benefit of input credit to his buyer.

Before opting you must consider the following-

Tips-

Needless to say that small business must do their math around the cost-benefit of voluntary registration under GST.

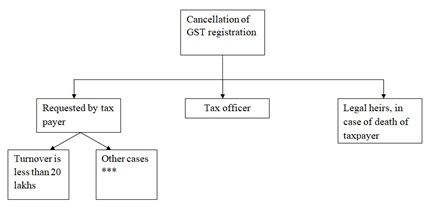

Cancellation of GST registration simply means that the taxpayer will not be a GST registered person any more. He will not have to pay or collect GST.

Consequences of Cancellation

Cancellation of GST registration can be done by:

*** Application for cancellation, in case of voluntary registrations made under GST, can be made only after one year from the date of registration.

Here is a list of all the returns to be filed as prescribed under the GST Law along with the due dates.

As per the CGST Act subject to changes by CBIC Notifications

| Return Form | Description | Frequency | Due Date |

| GSTR-1 | Details of outward supplies of taxable goods and/or services affected. | Monthly | 11th* of the next month with effect from October 2018 until September 2020. *Previously, the due date was 10th of the next month. |

| Quarterly (If opted) | End of the month succeeding the quarter. | ||

| GSTR-2 Suspended from September 2017 onwards | Details of inward supplies of taxable goods and/or services effected claiming the input tax credit. | Monthly | 15th of the next month. |

| GSTR-3 Suspended from September 2017 onwards | Monthly return on the basis of finalisation of details of outward supplies and inward supplies along with the payment of tax. | Monthly | 20th of the next month. |

| GSTR-3B | Simple return in which summary of outward supplies along with input tax credit is declared and payment of tax is affected by the taxpayer. | Monthly | Staggered^ from the month of January 2020 onwards* *Previously 20th of the next month for all taxpayers. |

| 20th of next month for taxpayers with an aggregate turnover in the previous financial year more than Rs 5 crore. For the taxpayers with aggregate turnover equal to or below Rs 5 crore, 22nd of next month for taxpayers in category X states/UTs and 24th of next month for taxpayers in category X states/UTs

| |||

| CMP-08 | Statement-cum-challan to make a tax payment by a taxpayer registered under the composition scheme under section 10 of the CGST Act (supplier of goods) and CGST (Rate) notification no. 02/2019 dated 7th March 2020 (Supplier of services) | Quarterly | 18th of the month succeeding the quarter. |

| GSTR-4 | Return for a taxpayer registered under the composition scheme under section 10 of the CGST Act (supplier of goods) and CGST (Rate) notification no. 02/2019 dated 7th March 2020 (Supplier of services). | Annually | 30th of the month succeeding a financial year. |

| GSTR-5 | Return for a non-resident foreign taxable person. | Monthly | 20th of the next month. |

| GSTR-6 | Return for an input service distributor to distribute the eligible input tax credit to its branches. | Monthly | 13th of the next month. |

| GSTR-7 | Return for government authorities deducting tax at source (TDS). | Monthly | 10th of the next month. |

| GSTR-8 | Details of supplies effected through e-commerce operators and the amount of tax collected at source by them. | Monthly | 10th of the next month. |

| GSTR-9 | Annual return for a normal taxpayer. | Annually | 31st December of next financial year. |

| GSTR-9A | Annual return to be filed by a taxpayer registered under the composition levy anytime during the year. | Annually | 31st December of next financial year. |

| GSTR-9C | Certified reconciliation statement | Annually | 31st December of next financial year. |

| GSTR-10 | Final return to be filed by a taxpayer whose GST registration is cancelled. | Once, when GST registration is cancelled or surrendered. | Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR-11 | Details of inward supplies to be furnished by a person having UIN and claiming a refund | Monthly | 28th of the month following the month for which statement is filed. |

* Subject to changes by Notifications/ Orders

**Statement of self-assessed tax by composition dealers – same as the erstwhile form GSTR-4, which is now made an annual return with effect from FY 2019-2020 onwards.

STEPS FOR UPLOADING GST RETURN TEMPLATE

1. Download the above GST Return Template File.

2. Edit the necessary parts on it.

3. Upload the updated GST Return template file at the time of booking.