Share on Social 👇

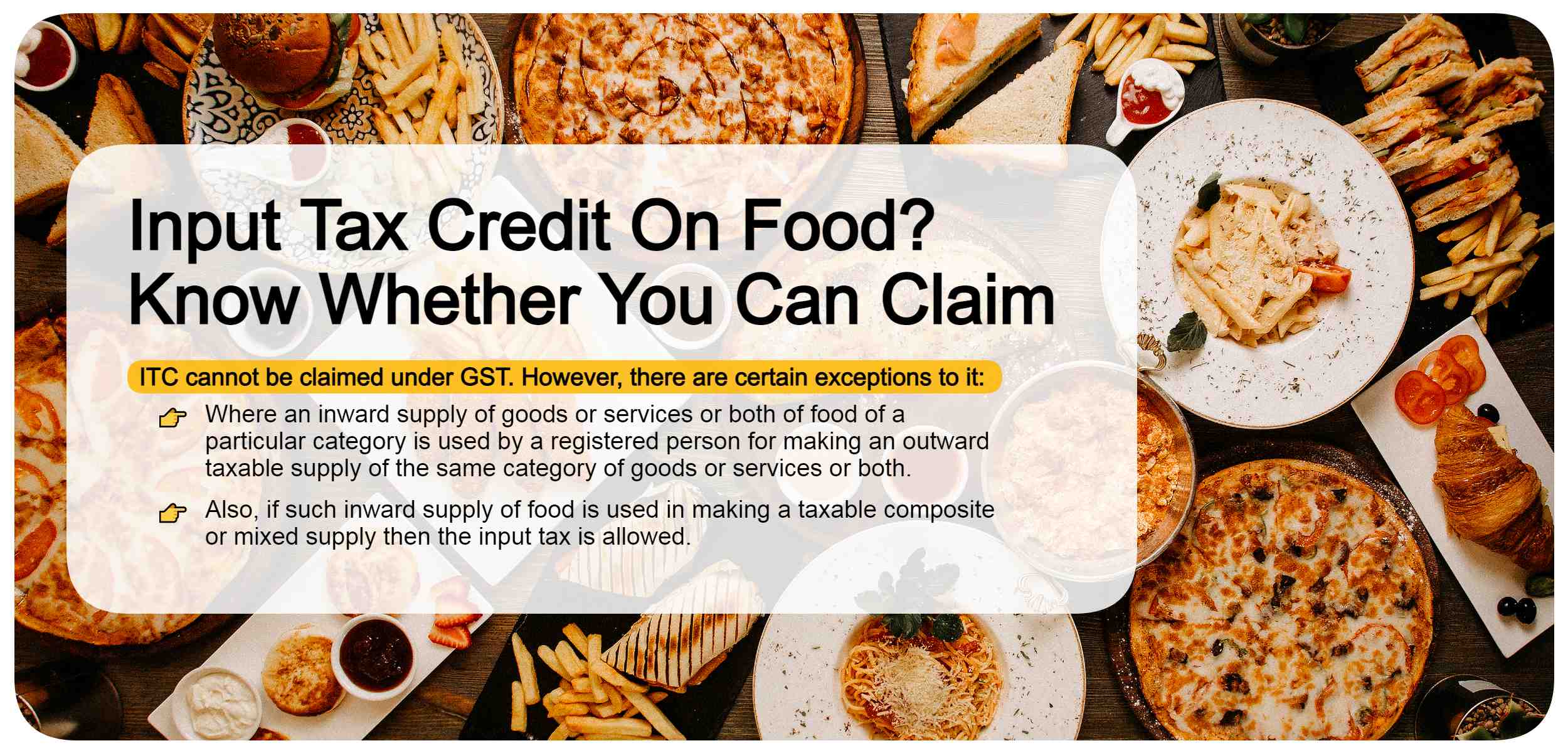

Input Tax Credit On Food? – Know Whether You Can Claim

The input tax credit on food and beverage supplies are blocked credit for registered person. However, there are certain exceptions wherein the registered person can claim ITC on food.

The input tax credit on food and beverage supplies are blocked credit for registered person. However, there are certain exceptions wherein the registered person can claim ITC on food.

If coffee and tea are packed in a packet having registered trademark or brand name, then GST will be applicable. And, the company can claim ITC, if the taxable invoice has been issued.

Yes, restaurant registered as normal tax payer are eligible to claim ITC. As an inward supply of goods or services are used for making an outward taxable supply.

Summary:

For Availing Income Tax Return Filing Services

Kindly click on the button 👉