Change in the Name of a company (The rate is applicable for authorized capital upto Rs 10 Lakhs)

Note:

Change in the Name of a company (The rate is applicable for authorized capital upto Rs 10 Lakhs)

Note:

According to the Companies Act, 2013, a ‘Company’ means a Company incorporated under this Act or under any previous Company Law (Section 2 (20).

‘Private Company’ means a Company is a private Company within the meaning of section 2(68) of Companies Act, 2013 and accordingly.

The Company have a minimum paid-up share capital as may be prescribed and which by its articles:

Provided that where two or more persons hold one or more shares in a company jointly, they shall, for the purposes of this clause, be treated as a single member:

Provided further that:

Company Incorporation steps as follows:

Select, in order of preference, at least two suitable names up to a maximum of six names, indicative of the main objects of the company.

Ensure that the name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950) by availing the services of checking name availability on the portal.

Apply to the concerned ROC to ascertain the availability of name in SPICE+PART-Aby logging in to the portal. A fee of Rs. 1000/- has to be paid alongside. If proposed name is not available, the user has to apply for a fresh name on the same application. The applicant may go for incorporation simultaneously.

Otherwise, after the name approval the applicant has to apply for incorporation through SPIECE+PART-B within 20 days of name approval

Arrange for the drafting of the Memorandum and Articles of Association

Get the Memorandum and Articles signed by at least two subscribers in his/her own hand, his/her father’s name, occupation, address and the number of shares subscribed for and witnessed by at least one person.

Ensure that the Memorandum and Article is dated on a date after the date of stamping.

Login to the portal and fill the following forms and attach the mandatory documents listed in the eForm

Submit the E-Forms after attaching the digital signature, pay the requisite filing fee. Once processing of the Form is complete, CRC shall issue Certificate of Incorporation.

Here are the various types of the companies you can register in India.

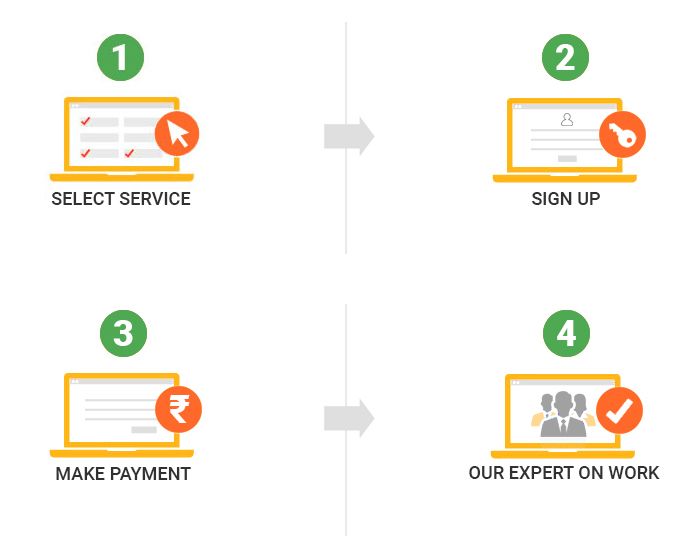

Follow the simple steps to register your Private Limited Company:-

Step 1: Obtain DSC (Digital Signature Certificate)

Step 2: Apply for DIN (Director Identification Number)

Step 3: Reserve your unique Name

Step 4: Form SPICe (INC-32)

Step 5: e-MoA (INC-33) and e-AoA (INC-34)

Step 6: PAN and TAN Application

Know in detail about the registration process

Registering a company under start-up India movement as start-up company is very Simple and online process. For that you need to follow the following procedure.

You must first incorporate the business as a Private Limited Company or a Partnership firm or a Limited Liability Partnership.

You have to follow all the normal procedures for registration of any business like obtaining certificate of Incorporation/Partnership registration, PAN and other required compliance.

Then the business must be registered as a start-up. The entire process is simple and online. All you need to do is log on to the Start-up India website and fill up the form with details of your business and upload certain documents.

Applying for Company’s name is an easy two step process:

Selection of a suitable name:

Select, in order of preference, at least one suitable name up to a maximum of six names, indicative of the main objects of the company.

Ensure that the name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950) by availing the services of checking name availability on the portal.

Application to concerned ROC:

Apply to the concerned RoC to ascertain the availability of name in eForm1 A by logging in to the portal. A fee of Rs. 500/- has to be paid alongside and the digital signature of the applicant proposing the company has to be attached in the form. If proposed name is not available, the user has to apply for a fresh name on the same application.

You need the following documents to register your Company.

MOA stands for Memorandum of Association whereas AOA means Articles of Association. Both these documents act as an important source of information for various shareholders and other stakeholders associated with a Company.

MOA reveals the name, aims, objectives, registered office address, clause regarding limited liability, minimum paid up capital and share capital of the Company. In short, it explains the relationship of a Company with the outside world.

AOAs are the necessary documents to be submitted when the company is incorporated with the Registrar of Companies (ROC). When AOAs are in conjunction with the MOA, they are called the Constitution of the Company.

DSC stands for Digital Signature certificate. DSC is the digital equivalence of physical papers or certificates. It is needed to file the form electronically with the concerned department. For the purpose of Company Registration of a private company, DSC for one of the Directors is required.

DIN, Directors Identification Number, is actually an identification number issued to a Director or a prospective Director of a Company by the Ministry of Corporate Affairs, Government of India. The concept of DIN was introduced for the first time when Sections 266A and 266G were inserted in Companies Act.

To obtain a DIN, one needs to make an online application to the Ministry of Corporate Affairs and submit the required documents related to Identity and Address Proof. Once the Ministry verifies these documents, the DIN will be allotted to the person

The DPIN (Designated Partner Identification Number) used for identifying a designated partner in a Limited Liability Partnership (LLP) firm, is equivalent to the DIN (Director Identification Number) of a director of a private or public limited company. Both of these identifying numbers are issued by the Ministry of Corporate Affairs (MCA), Govt. of India.

Following the below given steps, you can check the status of the company registration.

Step 1: Go to the MCA website.

Step 2: Go to ‘MCA Services’ tab. In the drop-down click on ‘View Company/LLP Master Data’.

Step 3: Enter the companies CIN. Enter the captcha code. Click on ‘Submit’.

Now you will be able to view the exact status of your registration process.

Let’s see how Company formation puts you at an advantageous position.

Yes, Company Registration process in India is completely online. Today, company registration and other regulatory filings are paperless; documents are filed electronically through the MCA website and are processed at the Central Registration Centre (CRC), a dedicated back office for Company and LLP Registration process.

Upon completing all registration formalities, the Registrar of Companies’ issues a digitally signed Certificate of Incorporation (COI). Electronic certificates issued by the ministry can be verified by all stakeholders on the MCA website itself.

Yes, Rule 27 of Companies (Management & Administration) Rules 2014 says that A Listed Company or a Company having more than 1000 Shareholders shall maintain Records in electronic Format. However all the other Companies are required to maintain statutory records in the form of registers, minutes etc. throughout its life.

When you register a Private Limited Company, the promoters of your Company need to decide on the amount of authorised capital and the share value they will get in return if they invest in your Company.

Authorised Capital or Registered Capital is the maximum ceiling limit of the capital up to which a Company can issue shares and collect money from its shareholders. The authorised capital can also be enhanced by passing a resolution at a meeting of the shareholders.