All You Need To Know About Turnover Limit For Tax Audit

When Tax Audit is applicable?

I am a salaried employee; I also trade in future and option but incurred loss and my turnover is less than one crore. Do I require to get tax audit from a chartered accountant to carry forward loss? I have filed income tax return declaring loss but subsequently got defective notice u/s 139(9) from CPC for not submitting tax audit report or not submitting profit and loss account and balance sheet. Is tax audit mandatory to carry forward loss?

Above queries might be yours and thinking what to do to comply Tax provisions. Now no need to worry on how to comply tax provision, we at “Onlineideation.in” will analyse your transactions and file original or revised income tax return with or without tax audit report depending upon actual requirement under income tax law.

A recent amendment has increased confusion among the taxpayers regarding the applicability of tax audit. We try to analyse the various provisions relating to applicability of tax audit so as to provide clarity on the subject.

Section 44AB of the Income-tax Act requires an audit of the books of account and furnishing a tax audit report in Form 3CA/3CB/3CD received from a chartered accountant. The tax audit can be conducted by a Chartered Accountant who is in practice. The purpose of a tax audit is to ensure that the taxpayer has maintained proper books of account and complied with the provisions of the Income-tax Act.

Please note that the tax audit is mandatory only if you are falling under any one of the following clause of sec 44AB ie clause (a),(b),(c),(d),(e) of Sec 44AB of income tax Act.

- Tax Audit u/s 44AB(a):

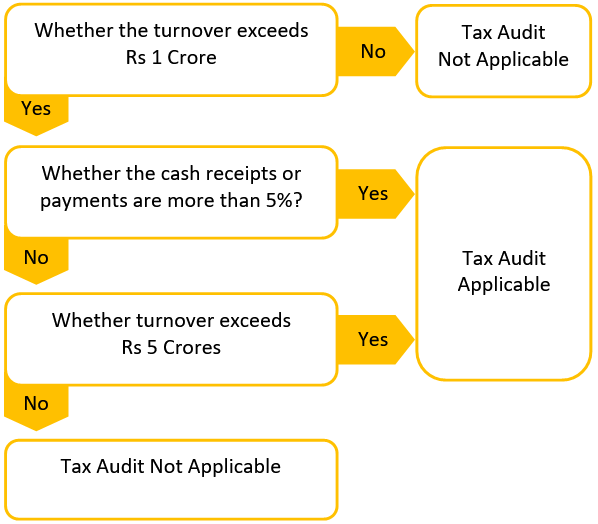

A person carrying on business, if his total sales, turnover or gross receipts (as the case may be) in business for the year exceed or exceeds Rs. 1 crore.

Exception 1 : This provision is not applicable to the person, who opts for presumptive taxation scheme u/s 44AD and his total sales or turnover doesn’t exceed Rs. 2 crores. In other words, If total sales, turnover or gross receipt is between 1 crore to 2 crores, he can declare profit @ 6% on digital turnover and profit @8% on cash sales u/s 44AD

Exception 2 : The threshold limit, (for a person carrying on a business) is increased from Rs. 1 Crore to Rs. 5 Crore in the case when both cash receipt or payment made during the year does not exceed 5% of total receipt or payment, as the case may be.

- Tax Audit u/s 44AB(b):

A person carrying on profession, if his gross receipts in profession for the year exceed Rs. 50 lakhs

- Tax Audit u/s 44AB (c)

A person carrying business of plying, hiring or leasing goods carriages (Sec 44AE), business of exploration, etc., of mineral oils (sec 44BB), foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects (Sec 44BBB) but claimed profit less than prescribed rate.

- Tax Audit u/s 44AB(d)

Specified professional who is eligible to opt for the presumptive taxation scheme of section 44ADA but he claims that his profits from profession are lower than the profits computed under Section 44ADA and total income exceeds the maximum exemption limit

- Audit u/s 44AB(e):

Carrying on the business and Sec 44AD(4) is applicable in his case and his income exceeds the maximum amount which is not chargeable to income-tax.

In other words, when the assessee declares profit as per the presumptive taxation scheme in any of the last 5 previous years but does not opt for the same in the current year, he shall be liable to get his accounts audited if his total income exceeds the maximum amount not chargeable to tax., Further he shall also not be eligible for the scheme for the next five years. In such cases, he shall maintain books of account and get books of account audited for the current year as well as for the next 5 year.

Let us consider few points so as to better understand the provision of applicability of Tax audit with effect from AY 2020-21 (FY 2019-20)

Note 1: The eligible assessee with turnover less than one crore can report income less than the deemed income of 6%/8% of the total turnover or gross receipts or declare loss, provided he maintains books of accounts as per section 44AA of the Income-tax Act. (Clause 40 of Circular No 3/2017 dt 20-01-2017).

Note 2: Tax audit for an assessee with turnover less than one crore is applicable only to whom sec 44AD(4) applies (as discussed above under clause 44AB(e))

Note 3: Clause 44AB(a) is applicable for the person carrying business whereas Clause 44AB(b) applicable for the person carrying Profession. The separate turnover limit is fixed for business and profession. Whether a particular activity can be classified as `business’ or `profession’ will depend on the facts and circumstances of each case.

The expression “profession” involves the idea of an occupation requiring purely intellectual skill or manual skill controlled by the intellectual skill of the operator, as distinguished from an operation which is substantially the production or sale or arrangement for the production or sale, of commodities (CIT Vs. Manmohan Das (Deceased) [1966] 59 ITR 699 (SC))

We can apply above principle to decide whether a particular activity can be classified as `business’ or `profession’

Note 4: Clause 44AB(b) is applicable for the person carrying any profession whereas option for presumptive tax scheme is applicable only for “specified Profession”. In other words only specified professional can declare 50% profit on turnover without maintaining books of account.

Following professional services are covered under “specified profession” – Sec 44AA

- Legal profession – Services provided by an advocate/firm of advocates.

- Medical profession – Services provided by doctors.

- Engineering profession – Services provided by consulting engineers, structural engineers, design and drawing services, technical certification etc.

- Architectural profession – Services provided by an Architect/firm of Architects

- Chartered Accountant, Cost Accountant

- Profession of Technical consultancy -business consultant, marketing consultant etc.

- Interior decoration Services ie designing, planning, consulting etc.

- Profession of Advertising -film artiste such as an actor, a cameraman, a director, etc.

- Authorized representative – a person, who represents any other person, on payment of any fee or remuneration, before any Tribunal or authority constituted or appointed by or under any law for the time being in force

- Company Secretary

- Professional in sports – Sports Persons, Umpires and Referees, Coaches and Trainers, Team Physicians and Physiotherapists, Event Managers, Commentators, Anchors and Sports Columnists.

Note 5: Enhanced turnover limit of Rs. 5 crores for tax audit applicable only if cash criteria Is fulfilled. It may be noted that conditions in respect of ‘amounts received’ and ‘payments made’ should be fulfilled separately. It means, if one of the conditions is not satisfied, then proviso would not apply. Threshold limit of 5% is prescribed separately for receipts/payments and ought to be applied accordingly.

The onus would be on the assessee to prove that he is eligible for increased threshold limit for not getting his accounts audited. He needs to ensure that his aggregate cash receipts and payments are within the limit of 5%. If he fails to do so, consequences would be a penalty under section 271B for failure to get accounts audited.

Note 6: Can the professionals avail the benefit of the enhanced turnover limit of Rs. 5 Crore for the tax audit? Clause (a) of Section 44AB talks about a person carrying on business whereas clause (b) talks about a person carrying on a profession. The new proviso to section 44AB providing the enhanced turnover limit of Rs. 5 crores for the tax audit is inserted below clause (a) to section 44AB. Thus, the persons engaged in the profession (all profession including specified professional) aren’t entitled to claim enhanced turnover limit of Rs. 5 crores for the tax audit.

Note 7: If the turnover of an assessee is more than Rs. 1 crore and his cash payment and receipt is less than 5%, whether he is liable to tax audit?

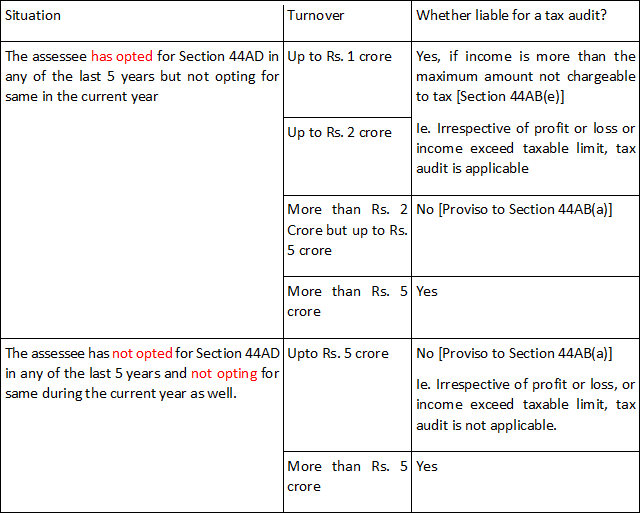

The answer to this question will depend on whether the assessee has opted for Sec 44AD in any of the last 5 years.

Let’s understand this with the help of the table below:

Note 7: Penalty for not filing Audit Report: if any person fails to get his accounts audited or fails to furnish the report of the audit the Assessing Officer may direct such person to pay a penalty of a sum equal to lower of following:

- 5% of the total sale, turnover or gross receipts; or

- 1,50,000/-

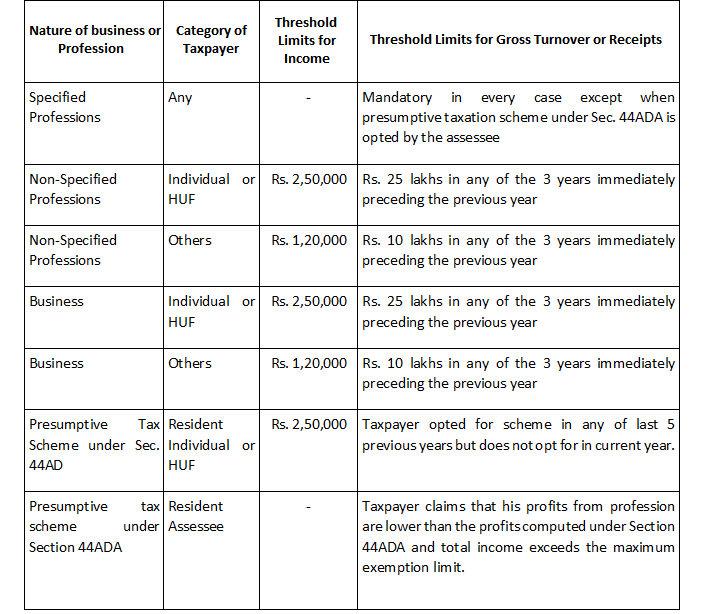

Note 8: Who is required to maintain books of accounts as per Section 44AA?

Section 44AA provides for maintenance of books of account by an assessee under the Income-tax Act.

The table below demonstrates the requirement for maintaining books of accounts by different taxpayers:

Note 9: Where an assessee is carrying on more than one business, sale turnover or gross receipts from all businesses shall be clubbed together. However, if the assessee is opting for the presumptive taxation scheme, the turnover of such businesses shall be excluded while determining his total sales turnover or gross receipts.

Note 10: Can the professionals avail the benefit of the enhanced turnover limit of Rs. 5 Crore for the tax audit? Clause (a) of Section 44AB talks about a person carrying on business whereas clause (b) talks about a person carrying on a profession. Enhanced turnover limit of Rs. 5 crores for the tax audit is inserted below clause (a) to section 44AB. Thus, the persons engaged in the profession aren’t entitled to claim enhanced turnover limit of Rs. 5 crore for the tax audit. For him turnover limit for tax audit is Rs. 50 Lakh.

Let us consider few examples for better understanding of turnover limit for tax audit

Example 1.

Turnover from F&O transaction of the assessee is Rs 90 Lakhs, Actual Loss from F&O business is Rs 5 Lakhs and Salary income Rs. 20 Lakhs. Whether tax audit is applicable?

Ans: Requirement of Tax audit will be depending on whether assessee opted for presumptive taxation in any of the five preceding previous years.

Not opted for presumptive taxation in any of the five preceding previous years:

In this case, the turnover of the assessee is less than Rs 1 Cr hence he shall not be liable for tax audit u/s 44AB(a). Further assessee has not declared profits as per presumptive taxation scheme in any of the five preceding years, hence he shall also not be liable for tax audit u/s 44AB(e) r.w.s 44AD(4). He has to maintain books of account u/s 44AA of the income tax act and file ITR 3 with profit and loss account and balance sheet.

Opted for presumptive taxation in one of the five preceding previous years ie filed ITR 4 of preceding year/s declaring deemed profit at 6%.

In this case, the turnover of the assessee is less than Rs 1 Cr hence he shall not be liable for tax audit u/s 44AB(a). But he has declared profits as per presumptive taxation scheme in any of the five preceding years, hence he shall be liable for tax audit u/s 44AB(e) r.w.s 44AD(4). His books of account have to be audited by the chartered accountant and file tax audit report ie Form 3CB/3CB.

Example 2.

Turnover of the assessee is 1.4 Crs, Cash receipts/payments are Rs 20 Lakhs, Profit from the business is Rs 7 Lakhs and Assessee has not opted for presumptive taxation in any of the five preceding previous years

Ans: In the given case the cash payment/receipts are greater than 5% of total payment/receipts hence he is liable for tax audit u/s 44AB(a) as the turnover exceeds the limit of Rs 1 crore and he has not declared profit in accordance with the provisions of sec 44AD. He can opt for 44AD and declare profit 6%/8% and if so, tax audit is not required.

Example 3.

Turnover of the assessee is 1.75 Crs, No Cash receipts/payments, declared Loss from business is Rs 5 Lakhs and Assessee had opted for presumptive taxation in one of the five preceding previous years

Ans: Cash payment/receipts are less than 5% of total payment/receipts hence the assessee shall not be liable for tax audit u/s 44AB(a) as per the proviso to sec 44AB(a). The assessee has declared profits as per presumptive taxation scheme in any of the five preceding years and has not declared profits as per presumptive taxation for the current year, hence the provisions of sec 44AD(4) shall apply and he shall be liable for tax audit u/s 44AB(e) r.w.s 44AD(4).

Example 4.

Turnover of the assessee is Rs.3 Cr, Cash receipts/payments are Rs 5 Lakhs, and declared profit from business is Rs 8 Lakhs.

Ans: In the given case the cash payment/receipts are less than 5% of total payment/receipts hence the assessee shall not be liable for tax audit u/s 44AB(a) as per the proviso to sec 44AB(a). As the turnover of the assessee is greater than Rs 2 Crores the provisions of sec 44AD will not be applicable in this case. Hence, there is no need to consider the applicability of sec 44AD(4).

Example 5.

The assessee is a freelance consultant having turnover of Rs. 60.00 Lakh and declared profit of Rs. 15.00 Lakh. No cash receipt or payment.

Ans: In the given case, he is liable for tax audit u/s 44AB(b) as his professional income exceeds Rs. 50.00 Lakh. Cash payment or receipt criteria is not applicable for professional income.

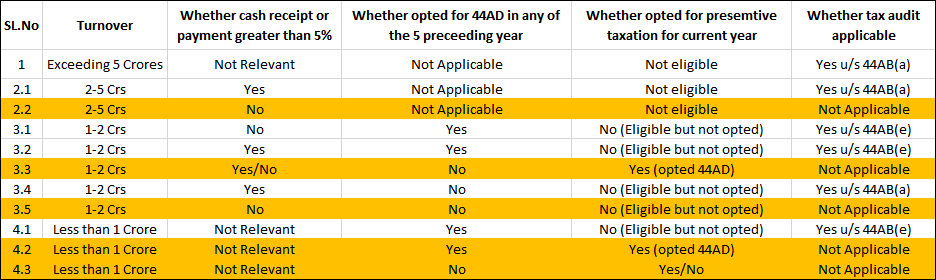

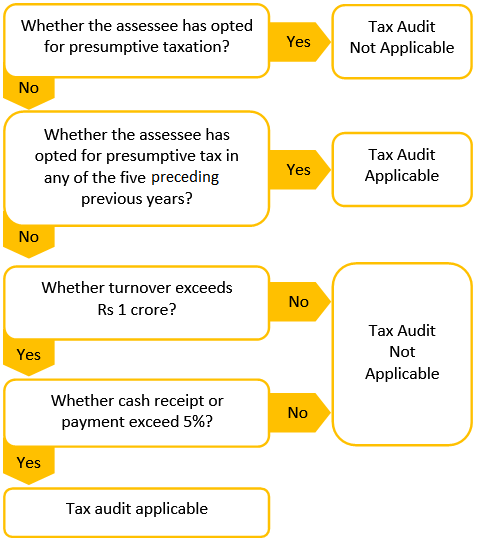

The chart summarizes the applicability of tax audit u/s 44AB(a) and sec 44AB(e)

Assessee engaged in business but not eligible for presumptive taxation u/s 44AD

Note: the above table applicable to following person who is not eligible to opt presumptive taxation u/s 44AD

- Non-resident

- LLP and Company

- Specified professionals as per Sec 44AA

- a person earning income in the nature of commission or brokerage

- a person carrying on any agency business

Assessee engaged in business but eligible for presumptive taxation u/s 44AD

You might be interested in:

Is Supply of Goods a Taxable Event Under GST Law ?

Whether Late Filing Fees (Interest u/s 234A) is Applicable For F.Y 2019-20?