Share on Social 👇

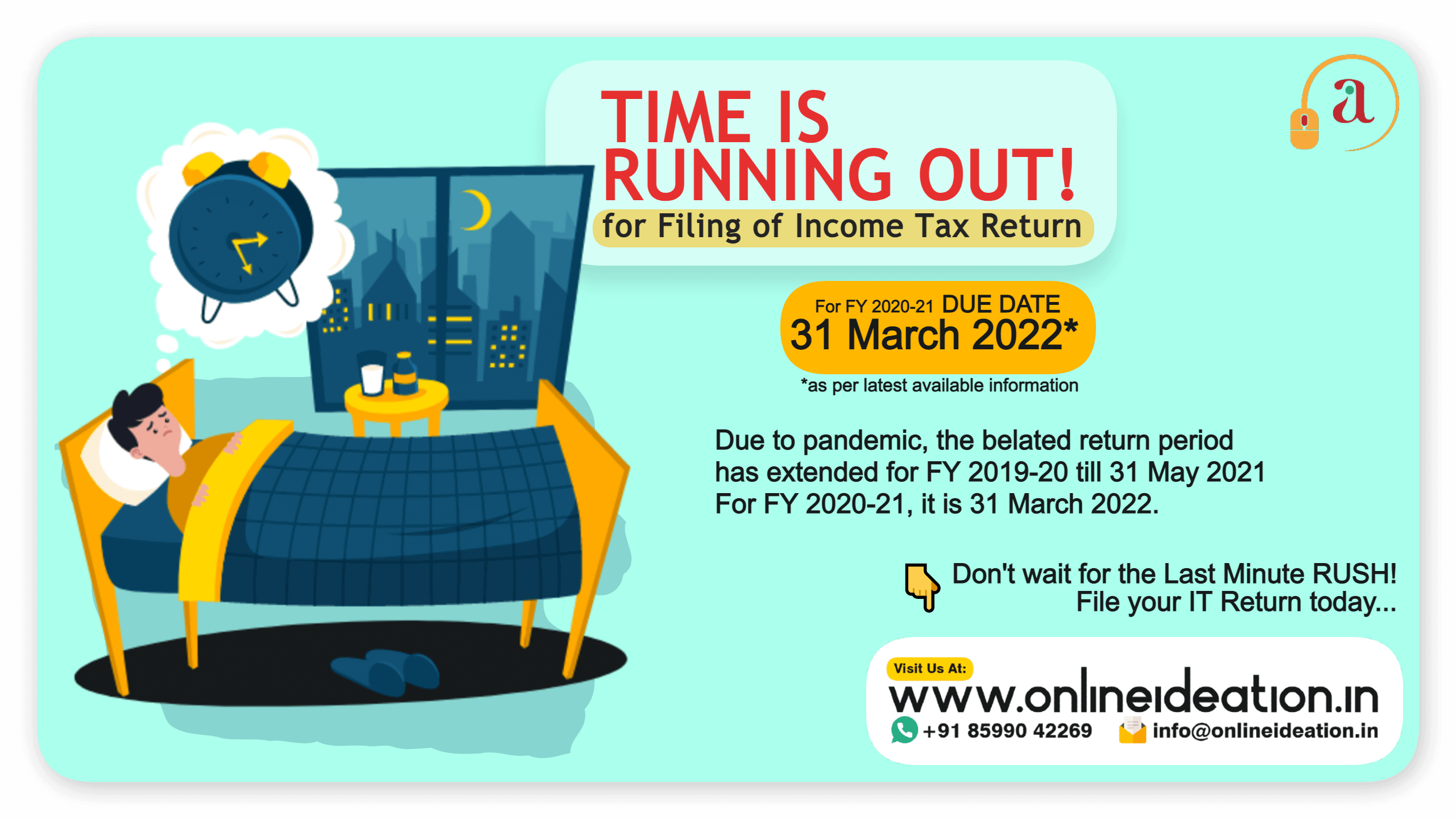

Belated Return Filing For FY 2020-21 – Due Date 31 March 2022*

Pandemic Year 2019-20:Due to pandemic, the belated return period has extended for FY 2019-20 till 31 May 2021. For 2020-21, it is 31 March 2022. |

Belated Return can be filed at any time before the end of the relevant assessment year or before the completion of assessment whichever is earlier.

In simple words, in case if you’ve not been able to file your income tax return before the prescribed due date, you can still file a belated return of income tax after the due date as well. Under Section 139(1), the normal due date of filing of income tax return is

| Particulars | Due Date |

Where the taxpayer is:

| 30th Sept of the Assessment Year |

| In case of any other category of taxpayer i.e. Salaried/ Self employed/ Contract Employee who are not required to get their tax audit done | 31st July of the Assessment Year |

However, in case you have missed the above deadline for filing of income tax return, you can still submit a belated return of income tax after the due date under Section 139(4)

Belated Return of Income Tax after Due Date

If a taxpayer fails to submit his income tax return

- On or before the due date mentioned under Section 139(1), or

- If the income tax return is not filed before the due date and the income tax officer has issued a notice under section 142(1) directing the taxpayer to file his income tax return within the time specified in the notice and he has not even filed his return as required in the notice, he can still file his income tax return even after the due date. Such an income tax return filed after the due date is called Belated Return.

Belated Return can be filed at any time before the end of the relevant assessment year or before the completion of assessment whichever is earlier (applicable from Assessment Year 2017-18 onwards). Lets understand this with the help of an example.

Example of Belated Income Tax Return after Due Date

The income tax return due date for the financial year 2017-18 is 31st July 2018/ 30th September 2018 (for the Financial year 2017-18, the Assessment year would be 2018-19).

If due to any reason, the taxpayer is not able to file his income tax return, he can still submit a belated return before the end of the assessment year i.e. before 31st March 2019. However, in case you have not filed your income tax return and the income tax officer has himself started conducting the assessment, the taxpayer can file his income tax return any time before the completion of assessment or before 31st March (whichever is earlier).

Interest under Section 234A for late filing

If a belated return is filed after the income tax due date, the taxpayer would be liable to pay the tax along with Interest @ 1% per month (simple interest) under Section 234A.

In case no tax is payable, the taxpayer won’t be liable to pay any interest for filing belated return of income tax after due date but before the end of the relevant assessment year.

Penalty for late filing of Income Tax Return

In case the Income Tax Return after the due date, it would be considered as a Belated Return and the following penalty would also be required to be paid

| Particulars | Amount |

| If the Income is less than Rs. 5 Lakhs | Rs. 1,000 |

| If the Income is more than Rs. 5 Lakhs | |

| Rs. 5,000 |

| Rs. 10,000 |

Relevant points regarding Belated Return

- Completion of Assessment means the due date on which the order of assessment was passed and not the date on which the order was received by the taxpayer. Thus a return submitted after the assessment is completed but before the date on which notice of demand is received by the taxpayer would be considered invalid. [Balchand v ITO (1969) 72 ITR 197(SC)]

- If the return is filed after the assessment which gets cancelled, the return would still be considered valid [Ram Billas Kedar NAth v ITO (1963) 47 ITR 586 (All)]

- Belated Return filed under Section 139(4) can also be revised. [Amendment introduced by Finance Act 2016 and applicable from Assessment Year 2017-18 onwards.]

- The Income Tax Dept vide Circular No. 9/2015 has allowed taxpayers to file ITR to claim Income Tax Refund or file Loss Return upto 6 years. However, such returns would only be accepted after a Letter for Condonation of Delay is filed with the Income Tax Dept and the same has been duely accepted by the Income Tax Officer.

Note: [Due date: 31 March 2022] – as per the available information as on the post publish date

For Availing Income Tax Return Filing Services

Kindly click on the button 👉