Impact of ITC on Capital Goods

The ITC on capital goods can be availed on the GST paid for business purposes. However, if the depreciation has been availed on GST paid while purchasing capital goods, then no ITC can be claimed.

ITC On Capital Goods

The ITC on capital goods can be availed like buildings, machinery, equipments, tools and vehicles that a person uses to produce goods or services. For example, machinery used in the manufacturing of wheat flour is a capital good and ITC can be claimed in such asset.

Capital Goods And Inputs

The GST ITC on capital goods can be claimed in the same way as inputs. The inputs are those which are used to make a final product and are considered as expenses

For instance, for making biscuit in an oven, the ingredients needed are water, flour, eggs and oil. These ingredients are considered as inputs and biscuit is the final product. Further, oven is the capital good which helps in making biscuit.

Having stated that, the capital goods are not consumed when the final product is made. They are not consumed in a single year of production. Therefore, they cannot be entirely deducted as business expenses in the year of their purchase. Instead, they are depreciated over the course of their useful lives. The business recognises part of the cost each year through accounting techniques as depreciation, amortization and depletion.

👉 Read About: Can You Claim HRA Even If You Own A House?

Types Of ITC On Capital Goods

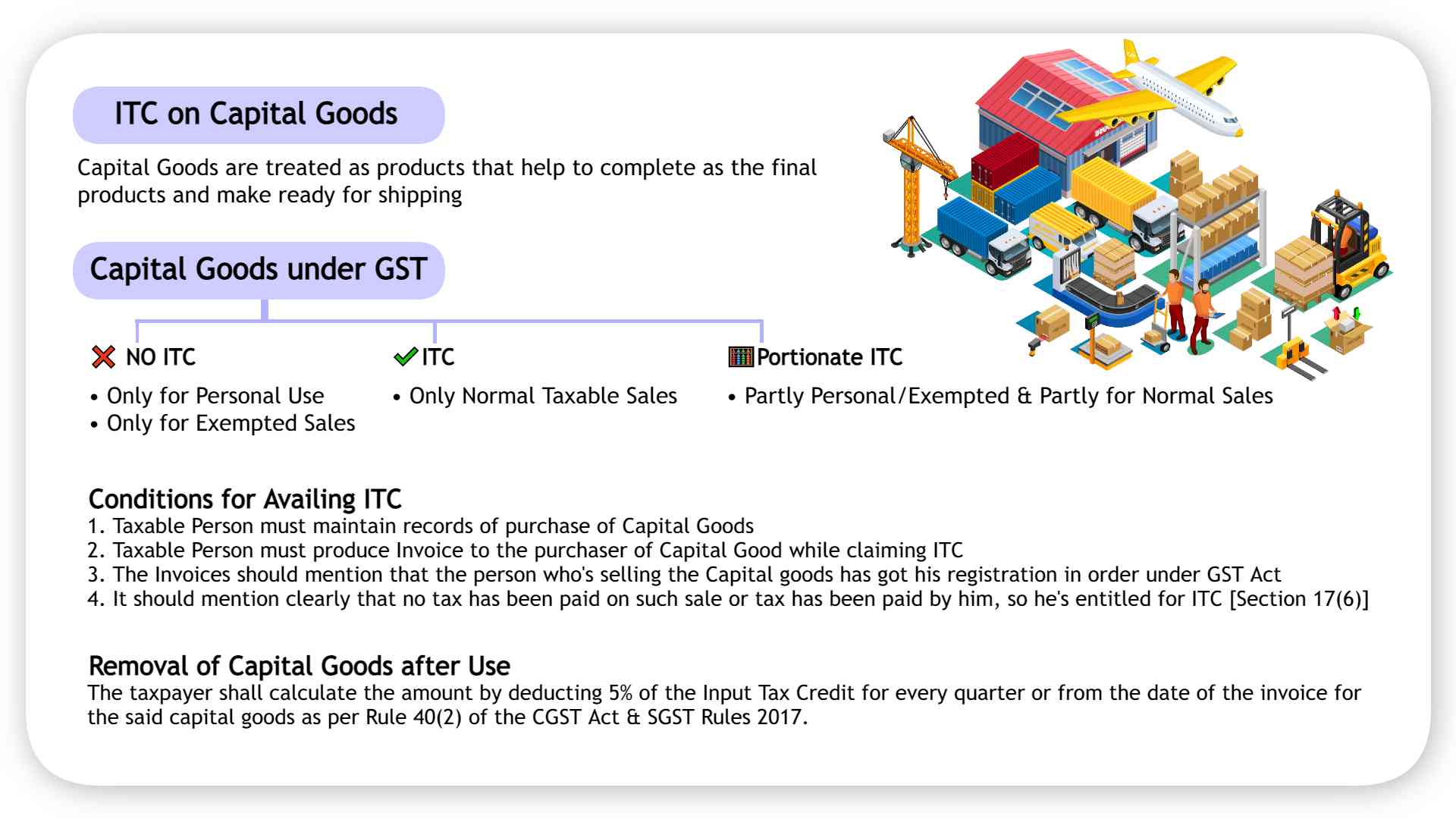

For the purposes of ITC on capital goods, the classification has been divided into three parts:

- It is only for personal use or exempted sales

- ITC on capital goods used for exempted sales

- It is for normal sales

GST ITC On Capital Goods For Personal Purposes Or Exempted Sales

The GST on capital goods can be claimed only for business purposes and not for personal purposes. Many people happen to claim GST ITC on capital goods held for personal purposes but that is wrong. Further, it cannot be claimed for goods used in exempted sales.

This will be indicated in GSTR-3B and shall not be credited to the electronic credit ledger.

For example, Hema has purchased a refrigerator for her home. Since, the fridge is not required for any business purpose, she will not be able to claim any GST ITC on capital goods.

If the capital goods are used for exempted sales, then no input tax credit can be availed.

Example: Ram is a manufacturer of khadi fabric and runs business for the same. Since he is a manufacturer of khadi, which is an exempted item under GST, no OTC can be availed.

Capital Goods ITC For Normal Sales

The GST ITC on capital goods can availed if they are used for normal sales.

Illustration:

ABC has purchased machinery to manufacture garments. Since, garments are normal taxable supplies, the GST included paid while purchasing machinery will be completely available as ITC.

👉 Read About: Consequences of Non TDS Deduction Compliances – A Comprehensive Guide

Case Where The Capital Good Is Partly Used For Business And Partly For Personal Purposes

If the capital good is used partly for business and partly for personal purposes, then ITC can be claimed only on business purposes.

For example, David is a freelancer and travel blogger. He has a personal laptop which hhe also uses for his freelance work. He can claim the input credit of GST paid on purchase of laptop only to the extent it pertains to her freelance business. David has also purchased a special editing software. Since this pertains only to his business, he can claim full ITC on this.

Conditions For Availing ITC On Capital Goods

- Taxable Person must maintain records of purchases of capital goods

- Taxable Person must produce Invoice to the purchaser of Capital Good while claiming ITC

- The invoices should mention that the person who is selling the Capital Goods has got his registration in order under GST Act

- It should mention clearly that no tax has been paid on such sale or tax has been paid by him, so he is entitled for ITC [Section 17(6)]

DISCLAIMER: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site doesn’t constitute legal or professional advice. It should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.