Income Tax On Income Of Minor Child – Treatment of Income of a Minor Child

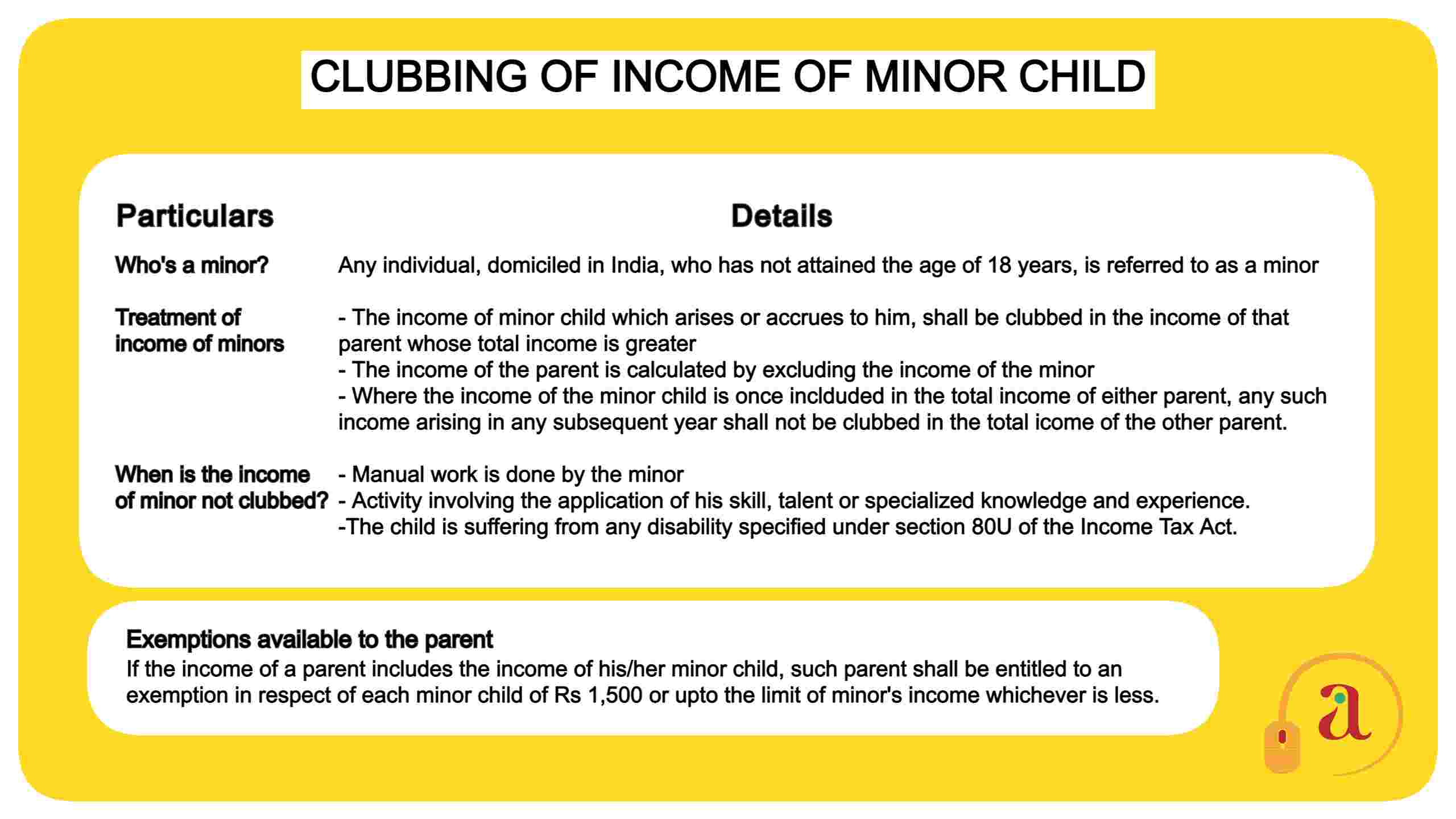

Many people think that the income earned by the minors is not taxable and if they transfer their income earned to their minor child, then it will lead to reduction of their tax liability. However, as per the provisions of Section 64 of Income Tax Act, if the minor earns any income, then that is clubbed with the income of their parents.

Clubbing of Income, in simple terms means that the income of one person is clubbed in the income of the other person. This clubbing of income can be done with the income of spouse, income of minor child, income from assets transferred to son’s wife/spouse, and so on. Having stated this, the income earned by minor is also taxable under the Income Tax Act.

Who Is A Minor?

As per the Indian Majority Act, 1875, the age of majority in India is specified as 18 years. Any individual, domiciled in India, who has not attained the age of 18 years, is referred to as a minor.

Treatment Of Income Of Minors

The income of minor child which arises or accrues to him, shall be clubbed in the income of that parent (mother/father) whose total income is greater.

Note:

– The income of the parent is calculated by excluding the income of the minor child under Section 64(1A) of the Act.

– The child also includes step child and adopted child.

In a case where the income of the minor child is once included in the total income of either parent, any such income arising in any subsequent year shall not be clubbed in the total income of the other parent, unless the A.O. (Assessing Officer) is satisfied, after giving an opportunity of being heard to that parent, that it is necessary so to do.

Illustration:

Illustration:

Taimur is the minor child of Tendulkar and Mrs Katrina. During the previous year 2020-2021, the income of Taimur was Rs. 2,500 and during this previous year, the income of Mrs. Katrina is higher than that of Tendulkar.

As per the provision stated above, the income of Taimur i.e., Rs. 2,500 will be clubbed in the income of Mrs. Katrina for the previous year 2020-2021. In the succeeding years (during the minority of the child), the income of Taimur will be clubbed in the income of Mrs. Katrina, even if the income of Tendulkar becomes higher than that of Mrs. Katrina in any of the subsequent years.

However, there is one exception to this clause. If in the succeeding years, the A.O. (Assessing Officer) wants to include the income of the minor child (Taimur) in the hands of Tendulkar, it can be done only if it is necessary to do so (not merely in the change in opinion of the Assessing Officer) and that too after giving an opportunity of being heard to Tendulkar.

Cases Where The Income Of Minor Will Not Be Clubbed With His/Her Parents Income

Clubbing of income of minor with the income of his/her parents shall not be done, in following cases:

- Income of a disabled child (disability of the nature specified in section 80U)

- Income earned by manual work done by the child or by activity involving application of his skill and talent or specialised knowledge and experience

- Also, money gifted to an adult child is exempt from gift tax under gifts to ‘relative’.

FAQ:

1. How is income of minor clubbed in the income of parent, if the marriage does not subsist?

Ans: The Income Of Minor Will Not Be Clubbed With The Income Of His Parent And Will Be Treated As A Part Of His Income In The Following Cases:– Income earned through activity involving the application of his skill, talent or specialized knowledge and experience – Income is earned by a child suffering with specified disability defined in Section 80U of the Income Tax Act. – Income earned by minor is through some manual work done by him.

Illustration: Mrs Sania has two minor children, viz., Rahul and Priyanka. Rahul is a child artist and Priyanka is suffering from diseases specified under section 80U of the Income Tax Act. Income of Rahul and Priyanka are as follows: Income of Rahul from stage shows: Rs. 1,00,000 Income of Rahul from fixed deposits invested by Mrs. Sania: Rs. 6,000 Income of Priyanka from fixed deposits invested by Mrs. Sania: Rs. 1,20,000.

Ans:

Name of the minor child | Source of Income | Amount | Reasons for clubbing/non clubbing of income |

Rahul | Stage Shows | Rs. 10,00,000 | Income is earned through activity involving the application of his skill, talent or specialized knowledge and experience. Therefore, income will not be clubbed |

Rahul | Interest on fixed deposits invested by Mrs. Sania (mother) | Rs. 6,000 | Income is not earned through any of the above 3 criterias. Therefore, income of Rahul will be clubbed with the income of Mrs. Sania. |

Priyanka (Is claiming deduction under Section 80U) | Interest on fixed deposits invested by Mrs. Sania (mother) | Rs. 10,000 | Priyanka is a minor suffering from disability specified under section 80U. Income will not be clubbed. |

5. Can the parent claim any benefit on clubbing of his income with minor’s income?

Ans: As per Section 64(1A) of the Income Tax Act, where the income of an individual also contains the income of his/her minor child, such individual shall be entitled to an exemption of Rs. 1,500 in respect of each minor child. However, where the income of any minor is less than Rs. 1500, then the aforesaid exemption shall be restricted to the income so included in the total income of the individual.

Illustration:

Illustration: