ITC on Motor Vehicle – All You Need To Know

ITC on motor vehicle is available on GST paid under certain circumstances. In this article, we’ve discussed everything about ITC on vehicle.

ITC on motor vehicle is available on GST paid under certain circumstances. In this article, we’ve discussed everything about ITC on vehicle.

ITC on Motor Vehicle Under GST

The ITC on motor vehicle under GST is available if such motor vehicles are used for making the following taxable supplies. However, there are certain conditions:

- Input Tax Credit (ITC) is admissible for motor vehicles which are used or intended to be used for transportation of goods

- ITC shall be allowable for passenger transport vehicles which are having approved seating capacity of more than 13 persons (including driver). There is no such restriction on ITC in this respect.

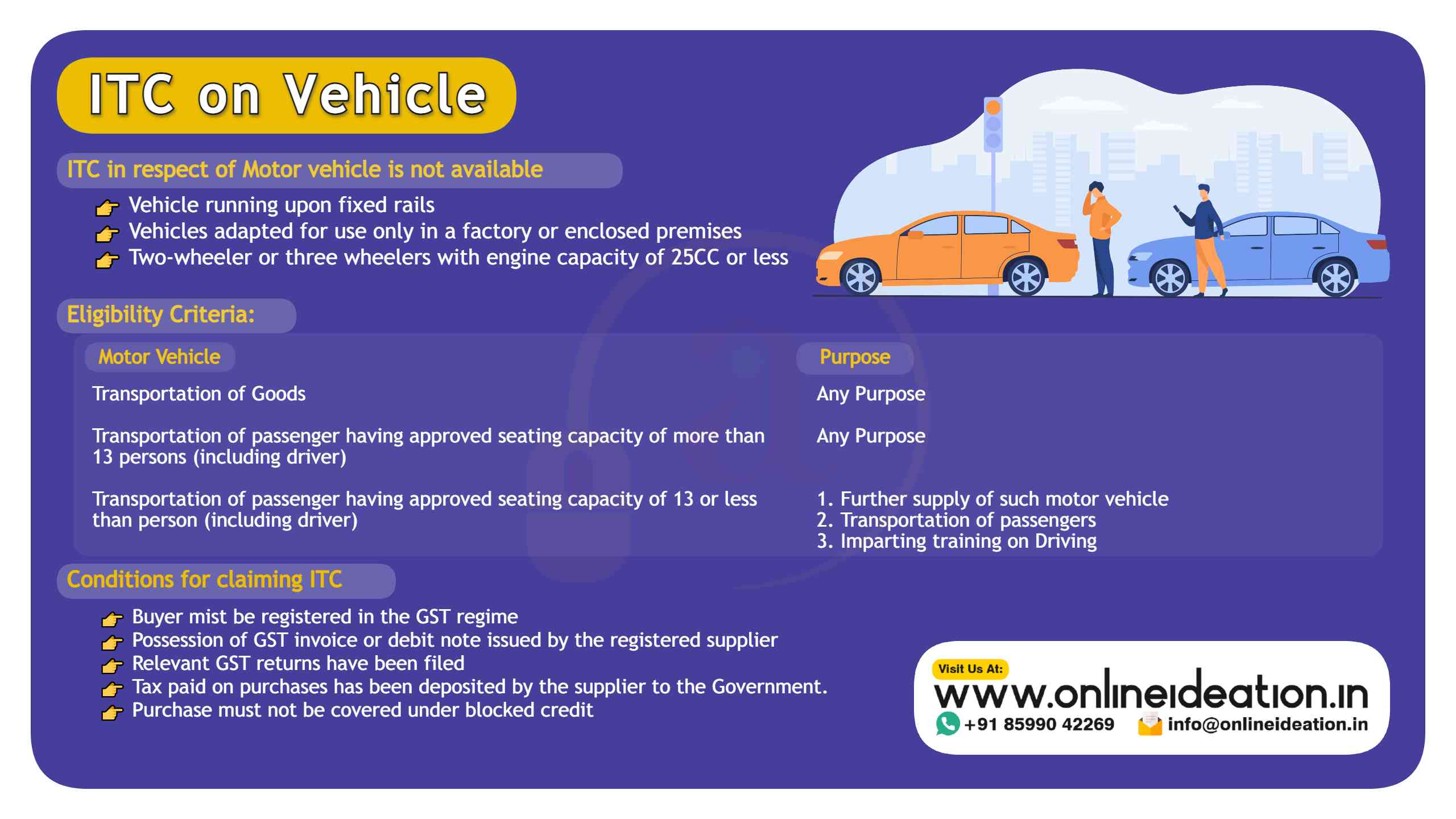

ITC in respect of Motor vehicle is not available

- Vehicle running upon fixed rails

- Vehicles adapted for use only in a factory or enclosed premises

- Two-wheeler or three wheelers with engine capacity of 25CC or less

Eligibility Criteria:

| Motor Vehicle Type | Purpose |

| Transportation of Goods | Any Purpose |

| Transportation of passenger having approved seating capacity of more than 13 persons (including driver) | Any Purpose |

| Transportation of passenger having approved seating capacity of 13 or less than person (including driver) |

|

👉 Read More: GST on Land & Building

Conditions for Claiming ITC

- Buyer mist be registered in the GST regime

- Possession of GST invoice or debit note issued by the registered supplier

- Relevant GST returns have been filed

- Tax paid on purchases has been deposited by the supplier to the Government.

- Purchase must not be covered under blocked credit

👉 Read About: GST ITC On Bank Charges – Everything to Know About

Cases Where ITC on Motor Vehicle Is Not Available

- It is not available which are used for transportation of persons having seating capacity of less than 13 including driver’s seat.

- It is also not available on the services of general insurance, servicing, repair and maintenance on motor vehicles used for transportation of persons having seating capacity of less than 13 including driver’s seat

Exceptions to case where ITC on motor vehicle is available even if seating capacity is less than thirteen are:

- Further supply of such motor vehicles:

If the registered person deals in further supply of motor vehicles, then he can claim ITC on vehicle even if the seating capacity is less than 13.- For example, Ram Automobiles Limited is an authorized dealer of Audi Cars in Delhi. It purchases cars from Audi for further sale to retail and corporate customers. Suppose, it purchases a car from Audi at Rs. 30,00,000 (GST 8,40,000) and sells it to Mr. Y for Rs. 35,00,000 (GST 9,80,000). Ram Automobiles Limited can claim ITC of Rs. 8,40,000 as it has acquired cars for the business of further supply and shall therefore pay net tax of Rs. 1,40,000 [9,80,000 – 8,40,000].

- Transportation of passengers:

Registered person who is engaged in the business of transportation of passengers, can claim ITC on vehicle for GST paid on purchase of vehicles like car. This claiming of ITC is not dependent on the seating capacity of the motor vehicle.- For example, Lakshman Tour and Travels is in the business of providing taxi services to tourists through cars. It purchased a car for providing such services. In this case, Lakshman Tour and Travels is eligible to take ITC for GST paid on purchase of car.

- Imparting training on driving on such vehicles:

Vehicle used for imparting driving training schools are also covered under this exception. If a vehicle driving training school purchases a motor vehicle with an intention to impart training on driving on such vehicles, ITC on purchase of such motor vehicle shall be available to it.- Similar restrictions are placed on ITC of general insurance services, servicing, repairs & maintenance services in relation to passenger motor vehicles having an approved seating capacity not more than 13 persons (including driver). According to GST law, ITC of the general insurance services, servicing, repairs & maintenance etc. shall be admissible in the three above cases.

Further, ITC on motor vehicle of the above input services shall also be available to a taxable person who is engaged in the manufacture of such motor vehicles.

Read More: GST on Advance Income – Basics Explained

Conclusion

To summarize, the following table sums up where ITC on motor vehicle is available and where it is not available:

Particulars of Motor vehicle | Transportation of Goods |

Use or Purpose | Any Purpose |

ITC available or not? | Yes |

Particulars of Motor vehicle | Transportation of passenger having approved seating capacity of more than 13 persons (including driver) |

Use or Purpose | Any Purpose |

ITC available or not? | Yes |

Particulars of Motor vehicle | Transportation of passenger having approved seating capacity of 13 or less than persons ( including driver) |

Use or Purpose |

|

ITC available or not? | Yes |

Particulars of Motor vehicle | Transportation of passenger having approved seating capacity of 13 or less than persons (including driver) |

Use or Purpose | Any Purpose except above 3 |

ITC available or not? | No |

DISCLAIMER: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site doesn’t constitute legal or professional advice. It should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Read About:

Read About: