Know About Late Fees & Interest On GST Returns

Late fees and interest under GST are imposed if the GST Returns are not filed on or due dates. Having said this, the GST registered person are required to file monthly returns twice every month and an annual return.

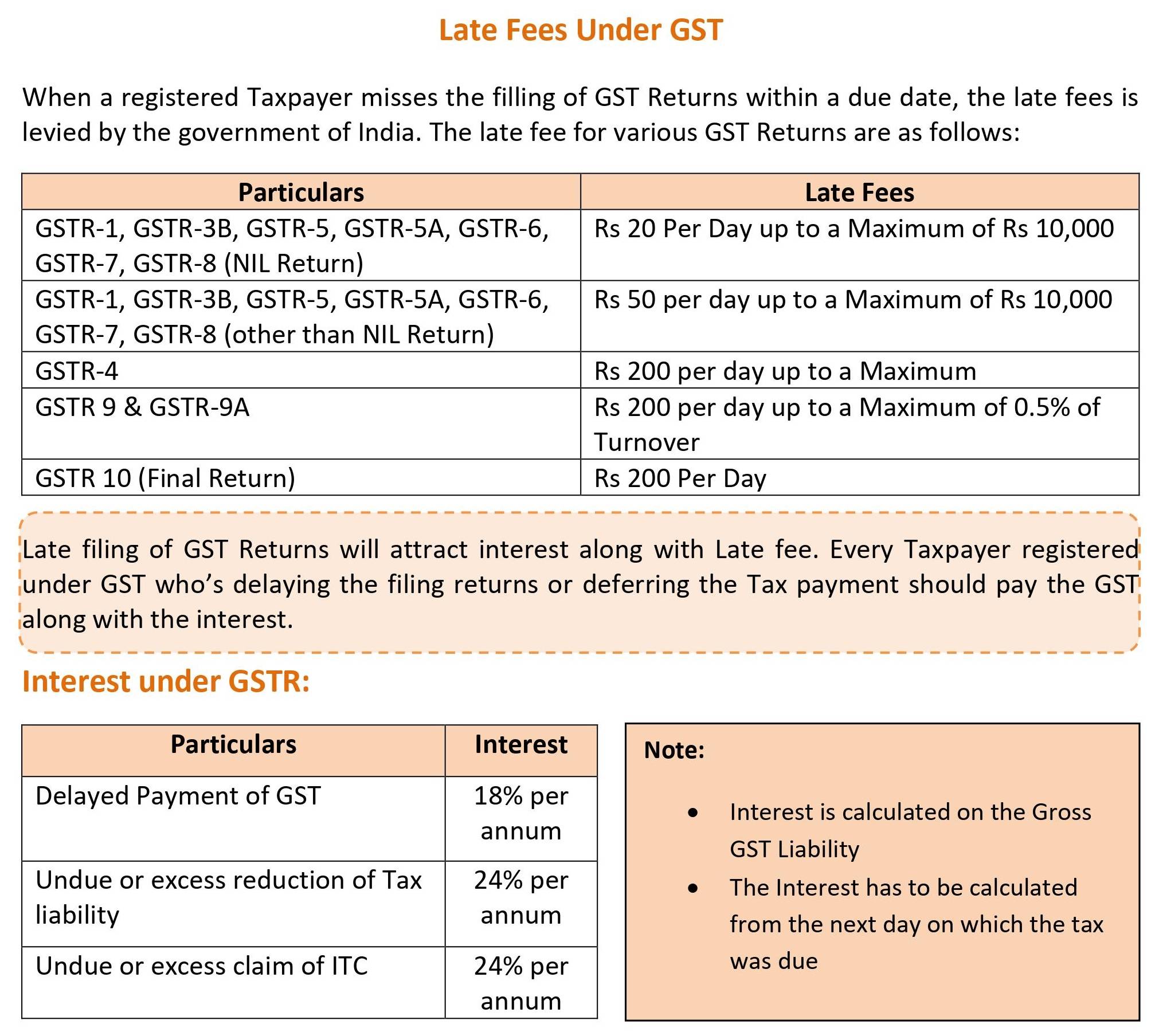

Late Fees Under GST

The late fees under GST is charged on the basis whether it is a:

- Monthly Nil GST Return

- Other than Nil Monthly GST Return

- Annual GST Return

👉 Read More: GST on Land & Building

Monthly Nil GST Return: Late Fees Applicable

Delay in filing of monthly GST Return attract late fees of Rs. 20 per day. From this Rs 10 is charged under the CGST Act and the rest under the SGST Act. Similar to other returns, interstate supplies will result in a late fees of Rs. 20 under the IGST Act.

👉 Read About: GST Rates On Textile And Garments

Other Than Nil Monthly GST Return

In case of delay in filing of other than Nil GST Return, late fees of Rs. 50 per day is levied. Having stated that, from this late fees, Rs. 25 goes to the Central Goods and Services Tax and Rs. 25 goes to the State/Union Territory Goods and Services Tax.

For interstate supplies, the late fee amounts to Rs. 50 per day under the Integrated Goods and Services Act, 2017. The maximum late fee limit as determined by the government is Rs. 5,000.

👉 Read More: GST on Advance Income – Basics Explained

Annual Returns: Late Fees

The filing of Annual Return after the due date attracts late fees of Rs. 200 per day (Rs. 100 CGST + Rs. 100 SGST/UTGST), wherein the maximum limit is 0.25% of the total annual turnover.

Taxpayers must pay all the late fee charges in cash separately for CGST, SGST and IGST via separate electronic cash ledgers. The GST portal automatically calculates and displays these values at the time of tax filing.

Interest On Late Fees Under GST Returns

Apart from the late fees, non-payment or delay in paying GST also attracts interest charges. The interest charges is to be paid in case the registered person:

- Pays GST after the due date

- Claims excess Input Tax Credit

- Reduces their output tax liability

👉 Read More: GST ITC On Bank Charges – Everything to Know About

Any tax paid after the due date attracts 18% interest. On the other hand, excess ITC claimed and reduced liability attracts an interest of 24%. The calculation of the new liability is based on these interest rates and it starts from the very next day of the due date. Hence, all business owners must pay their GST dues on time to avoid late fees and interest charges.

The Central Board of Indirect Taxes and Customs have decided to take strict action against non-filers of returns. In a recent meeting, the members has also suggested cancelling the GST registration of individuals who have failed to file their returns for six or more return periods.