Share on Social 👇

Mutual Fund Taxation SIP – All You Need To Know

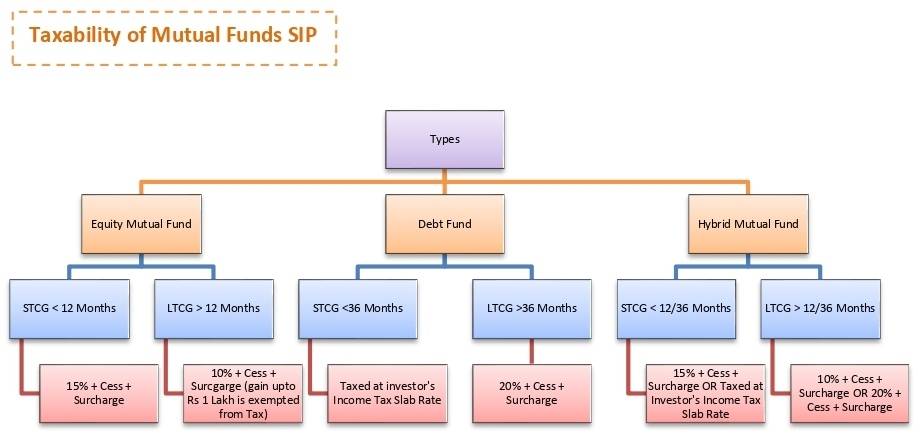

Mutual fund taxation is dependent on two factors namely: Type of the Mutual Fund & Duration of the Mutual Fund

All You Need To Understand About Mutual Fund Taxation SIP

| |||

| Mutual Fund | Duration | Capital Gain | Tax Rate |

| Equity Mutual Funds | Less than 12 Months | Short Term Capital Gains | @10% |

| More than 12 Months | Long Term Capital gains | @10% (Gain up to Rs 1 lakh is exempted from tax) | |

| Debt Mutual Funds | Less than 36 Months | Short Term Capital Gains | As per Income Tax Slab Rate |

| More than 36 Months | Long Term Capital Gains | @20% with indexation (listed funds) | |

| Hybrid Mutual Funds | Taxed as per type of fund: Equity/Debt | ||

There is a well-known proverb that the person should not put all the eggs in one basket and this still holds true. The person should not rely on only one type of investment. Therefore, he should invest in various plans and funds. In the current changing scenario, mutual funds are one of the most emerging and promising funds. Moreover, one can invest in these mutual funds through SIP or lumpsum amounts. So, read this blog to know about taxation on Mutual Funds SIP.

Before knowing the Mutual Fund taxation, one should know the following questions:

What Is Mutual Funds SIP?

Mutual Funds SIP is a Systematic Investment Planning method for investing in mutual funds. Furthermore, the investor through investing by way of SIP has an option to choose the frequency of the investment. Consequently, this frequency can be weekly / monthly / quarterly / bi-annually / annually.

Types Of Mutual Funds:

For purposes of investment and mutual fund taxation, the Mutual Funds are of three types:

(I) Equity Mutual Funds: Equity Mutual funds are those mutual funds which are primarily invest in stock market. In addition, on investing in these types of funds, money is invested in equity stocks on behalf of the person and a portfolio is created. Furthermore, profits or losses in this portfolio affect person’s Net Asset Value (NAV). These equity mutual funds have further classifications as per various types of funds, namely:

- Small-Cap Equity Funds

- Mid-Cap Equity Funds

- Large-Cap Equity Funds

- Large & Mid-Cap Equity Funds

- Multi-Cap Equity Funds

Note: Equity funds are those mutual funds whose portfolio’s equity exposure exceeds 65%.

(II) Debt Mutual Funds: Debt Mutual Funds are schemes that invest in fixed income instruments, such as Corporate and Government Bonds, corporate debt securities, money market instruments etc. that offer capital appreciation. Furthermore, these funds are also referred to as Fixed Income Funds or Bond Funds. Moreover, the investment in these funds is done in variety of securities, based on their credit ratings. The higher the credit rating is, the less volatile it will be. Apart from this, just like equity mutual funds, these debt mutual funds have further classifications into various types:

- Liquid Fund

- Money Market Fund

- Dynamic Bond Fund

- Gilt Fund

- Long Duration Fund

(III) Lastly, Hybrid Mutual Funds: Hybrid mutual funds are a combination of the above two mutual funds i.e., Equity Mutual Funds and Debt Mutual Funds. In addition to this, these funds try to create a balancing portfolio to offer regular income to its investors along with capital appreciation. Moreover, the hybrid mutual funds can be either

- Hybrid Equity oriented funds, or

- Hybrid Debt oriented funds

Mutual Funds Taxation

Mutual fund taxation is dependent on two factors:

- Type of Mutual Fund

- Duration of Mutual Fund

We have already you about the type of Mutual Funds, now comes the question of the duration of mutual fund

Duration Of Mutual Fund

The duration of a mutual fund is divided into two types:

- Short Term Mutual Fund

- Long Term Mutual Fund

The bifurcation of duration based on the type of mutual fund is as follows:

Mutual Fund Type | Short-term capital gains | Long-term capital gains |

Equity Mutual Funds | Shorter than 12 months | Longer than 36 months

|

Debt Mutual Funds | Shorter than 36 months | Longer than 36 months |

Hybrid equity-oriented Mutual Funds | Shorter than 12 months | Longer than 12 months |

Hybrid debt-oriented Mutual Funds | Shorter than 36 months | Longer than 36 months |

Taxability Of Mutual Fund SIP On Basis Of Type And Duration

The taxability of mutual fund SIP on the basis of type and duration is as follows:

Mutual Fund Type | Short-term capital gains | Long-term capital gains |

Equity Mutual Funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge

|

Debt Mutual Funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

Hybrid equity-oriented Mutual Funds | 15% + cess + surcharge | Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

Hybrid debt-oriented Mutual Funds | Taxed at the investor’s income tax slab rate | 20% + cess + surcharge |

Note: In the case of investment in mutual funds through SIP, each instalment is considered a fresh instalment. Therefore, the holding period of each instalment is calculated.

Illustration 1

Shilpa started a monthly SIP in an equity scheme on 1st January, 2019. Furthermore, on 2nd January, 2020, she decided to redeem the entire investment.

In this case, only capital gains on the units purchased from Shilpa’s first instalment (invested on 1st January 2019) will be long-term capital gains as she has held them for a period greater than one year. Moreover, for the remaining units, the holding period is lower than one year. Hence, the gains will be taxed at short-term capital gains rates.

Illustration 2

Name | Other Income | Type of Mutual Fund | Investment Period | SIP Amount | Capital Gain | Tax Applicable | Reasons |

Lekha | Rs. 1,00,000 | Equity Mutual Fund | 1st Jan, 2019 – 1st Dec, 2019 | Rs. 10,000 | Rs. 50,000 | Rs. 7,800 | Since Lekha has invested for less than 12 months, the income will be classified as short term capital gains. |

Sanya | Rs. 1,00,000 | Equity Mutual Fund | 1st Jan, 2019 – 1st March, 2020 | Rs. 10,000 | Rs. 90,000 | Rs. 0 | Since Sanya has invested for more than 12 months, income will be classified as long term capital gain. However, the long term capital gains of up to Rs. 1 lakh are exempted from tax.

|

Sasuhma | Rs. 1,00,000 | Debt Mutual Fund | 1st Jan, 2019 – 1st Dec, 2019 | Rs. 10,000 | Rs. 50,000 | 0 (Income below Rs. 2,50,000) | Sashuma has invested in debt mutual funds for less than 36 months. Therefore, it is short term capital gain and tax liability will be calculated as per income tax slab rate. |

Nirmal | Rs. 1,00,000 | Debt Mutual Fund | 1st Jan, 2019 – 1st May, 2022 | Rs. 10,000 | Rs. 90,000 | Rs. 18,720 | Nirmal has invested in debt mutual funds for more than 36 months. Accordingly, tax on long term capital gains will be calculated |

FAQs

The person can claim deductions under Section 80C by investing in mutual funds. However, such mutual fund must be an Equity Linked Savings Scheme plan. The total savings under 80C that qualifies for deduction is Rs.1.5 lakhs (max).

Yes, ELSS comes with a locking period of 3 years. The investor can’t redeem the units before 3 years.

Mutual funds work as well as per the scenario in the market. Therefore, Mutual Fund investments are subject to market risks, read all scheme related documents carefully.