Share on Social 👇

Premature Withdrawal of Fixed Deposits – Know The Rules

Premature withdrawal of fixed deposits, as the name suggests is withdrawing the amount of the fixed deposits before their date of maturity. If you withdraw FD before its date of maturity, then you have to pay a certain amount of penalty to the bank.

Penalty On Premature Withdrawal Of Fixed Deposits

There is a penalty for premature withdrawal of fixed deposits to discourage the habit of frequent withdrawing of money. Further, the penalty for premature withdrawal of fixed deposits varies from bank to bank. However, it usually ranges between 0.5% and 1%. In addition to this, there are certain banks as well as financial institutions that offer premature withdrawal with zero penalty charges.

Interest Rates In Case Of Premature Withdrawal Of Fixed Deposits

When you close a fixed deposit before its due date of maturity, then you have to face two consequences:

- Pay penalty @0.5% – 1%

- Get your FD amount on a lesser interest amount.

On closing of the FD before the actual date, the investor is given the amount at a lower rate of interest than that was offered initially.

As an illustration, suppose Lalit invests Rs. 1,00,000 through fixed deposits that pay 6% interest each year for five years. Consequently, the generation of interest for the first year annually was 4.5%. Now, if he wishes to prematurely withdraw a fixed deposit after one year. Then he will get 4.5% annually rather than 6% in interest. Further, he will also have to pay a penalty of a maximum of 1%. The computation of the same is as follows:

Parameters | Premature withdrawal of Fixed Deposits | Withdrawal of Fixed Deposits on date of maturity |

Principal Amount | Rs. 1,00,000 | Rs. 1,00,000 |

Booked Interest Rate on a Five-year FD | 6% p.a. | 6% p.a. |

Maturity Amount after One Year | Rs. 1,06,136 | Rs. 1,06,136 |

Interest Rate on One-year FD (at the time of booking an FD) | 4.5% p.a. | 4.5% p.a. |

Effective Rate of Interest | 4.5% p.a. | 6% p.a. |

Premature Withdrawal Penalty Charges | 1% | – |

Final Rate of Interest Payable | 3.5% p.a. | 6% p.a. |

Amount Receivable on Premature Withdrawal | Rs. 1,03,546 | Rs. 1,34,686 |

From the above illustration, it is safe to say that one should wait for the fixed deposits to mature and then, withdraw the money. If you choose to withdraw money from FD prematurely, then you will have to pay a penalty and may get an amount at lesser interest rates.

How To Avoid Premature Withdrawal Of Fixed Deposits?

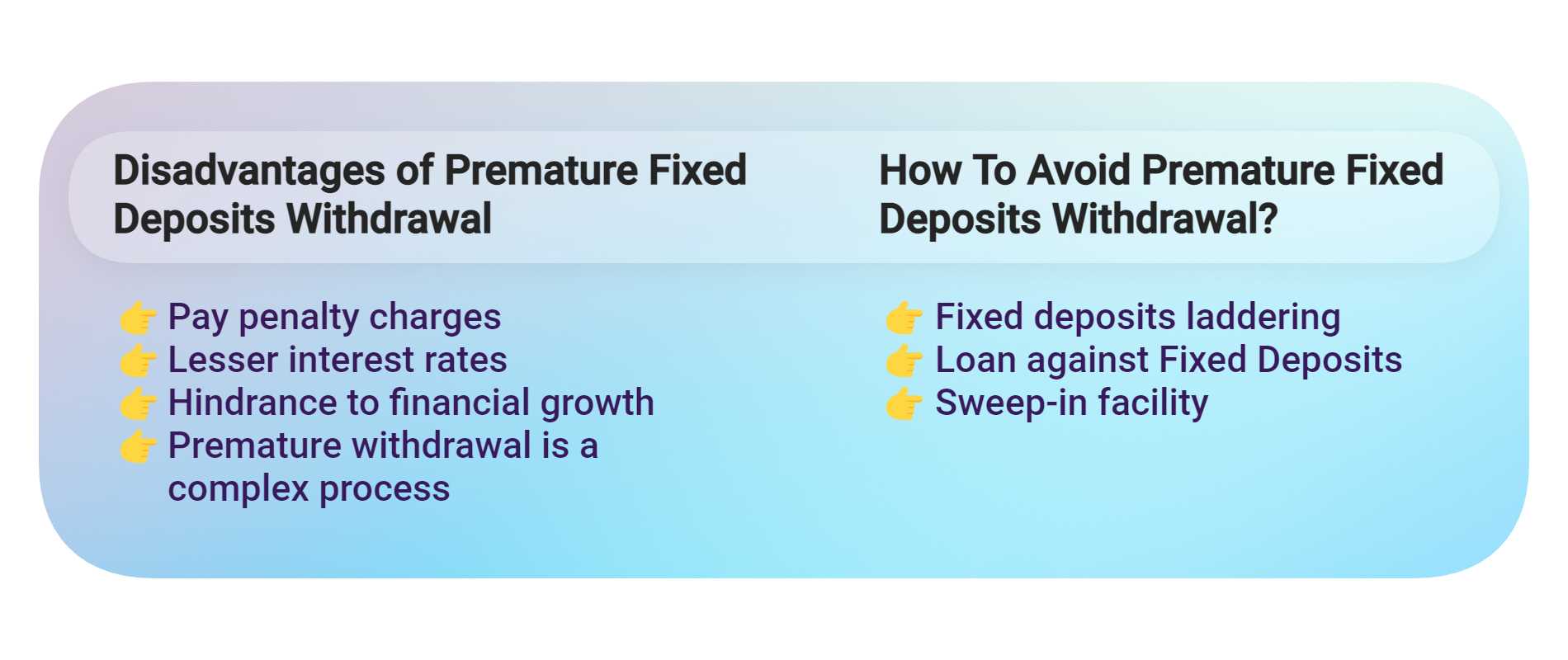

There are three different ways wherein you can avoid premature withdrawal of fixed deposits. These are as follows:

- FD laddering

- Loan against Fixed Deposits

- Sweep-in facility

- FD Laddering

FD laddering, as the name suggests is investing in FD schemes with different maturity periods. In this process, the investor divides his lump-sum amount into smaller investments. And, this is done by opening multiple numbers of fixed deposit accounts. For instance, if you have a lump-sum amount of say, Rs. 15 lacs. Then you can invest it In five different FDs of Rs. 3 lacs each with maturity periods ranging between one to five years. By doing so, you will have funds in form of short-term liquidity as well as long-term investments. Further, through FD laddering, you can also save a huge amount of money if there is a need for premature withdrawal of FD. For example, if you happen to be in dire need of Rs. 5 lacs and you have no funds in reserve, then you can premature your two FDs without disturbing the other three FDs. In this way, you will only have to pay a penalty only on the premature withdrawal of 2 FDs and not all the 5 FDs. - Loan against Fixed Deposits

The second option to avoid premature withdrawal of FDs is a loan against the FD amount. The banks generally charge 1% – 2% of interest for loans against these deposits. However, this rate of interest may vary from bank to bank. - Sweep-in facility

The last and one of the most effective options to avoid premature withdrawal of FD is the sweep-in facility. Through this facility, you allow your bank to transfer the excess amount in your savings account to a sweep-in deposit. Accordingly, this deposit becomes a separate corpus that you can withdraw at the time of emergency. However, please note that in order to be eligible for this facility, you might be required to open an FD account with a minimum amount of Rs.25,000 in your savings account. Further, the tenure of the sweep-in account may range from one to five years.

Disadvantages Of Premature Withdrawal Of FDs

When an investor chooses to prematurely withdraw his investments in FDs, he has to face the following disadvantages:

- Penalty: In case of premature withdrawal of FD, the investor will have to pay a penalty of a certain amount to the bank. And, the penalty rates may be between 0.5% – 1%.

- Loss of interest: For withdrawing FD prematurely, the investor is aware that he will not be able to claim the entire amount of the interest. One can claim the whole amount of interest only if he withdraws the amount on the date of maturity. Accordingly, there is a loss of interest on premature withdrawal of FDs.

- Hindrance to financial growth: By depositing money in fixed deposits, the investor is ensured of financial growth on the date of maturity. But if he has to withdraw the FD prematurely, then it can disturb his whole cash flow as well as budget. Therefore, withdrawing FD before the due date also acts as a hindrance to financial growth.

- Premature Withdrawal is a Complex Process: In addition to the above, premature withdrawal of FD is a complex process and not a straightforward transaction. This is because, to withdraw funds from FDs before the maturity date, one has to go through various processes like filling out the forms, meeting the officials of the banks, submitting the documents, and various formalities.

Accordingly, one should think twice before withdrawing funds through premature withdrawal of FDs.