Reverse Charge Provision Under GST and RCM on Goods

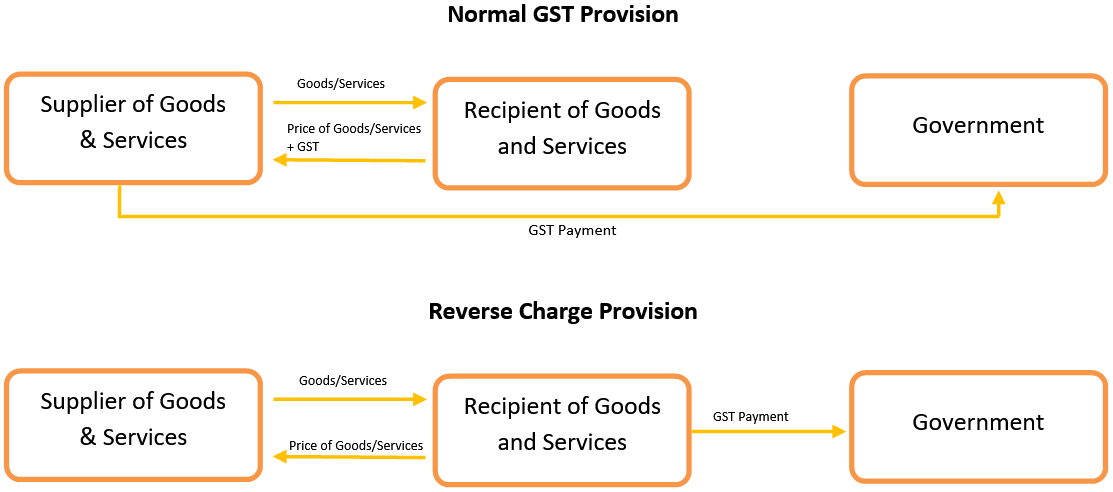

Under the normal provisions of GST, a supplier of goods and services is taxable person liable to pay tax on such supplies. However, in certain cases specifically provided by law, the recipient of such supplies is liable to discharge such tax liabilities on such supplies. This is the concept of Reverse Charge Mechanism(RCM).

Below is the pictorial representation on the difference between Normal GST and RCM:

Notified Goods under Charge Mechanism – Section 9(3) of the CGST Act/section 5(4) of the IGST Act:

| Sl. No. | Description of Supply of Goods | Supplier of Goods | Recipient of Goods |

| 1 | Cashew nuts, not shelled or Peeled | Agriculturist | Any Registered person |

| 2 | Bidi wrapper leaves (Tendu) | Agriculturist | Any Registered person |

| 3 | Tobacco Leaves | Agriculturist | Any Registered person |

| 4 | Silk Yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any Registered person |

| 5 | Raw Cotton | Agriculturist | Any Registered person |

| 6 | Supply of Lottery | State Government/Union Territory or any local Authority | Lottery Distributor or Selling Agent. |

| 7 | Used vehicles, seized and confiscated Goods, Old & Used Goods, Waste & Scrap | Central Government, Sate Government, Unions Territory or Local Authority | Any Registered person |

| 8 | Priority Sector Lending Certificate | Any Registered Person | Any Registered person |

You might be interested in:

Is Supply of Goods a Taxable Event Under GST Law ?

Mandatory Fields a GST Invoice Should Have