Share on Social 👇

The New Section 194S – All You Need To Know

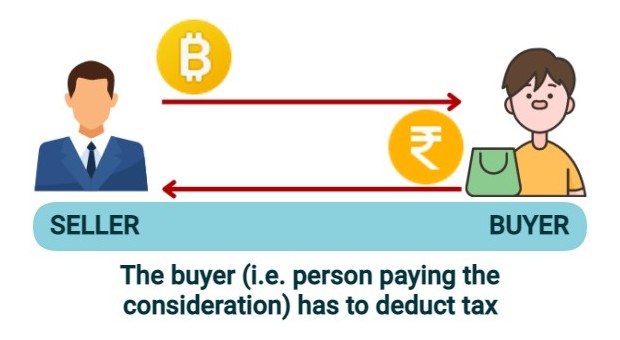

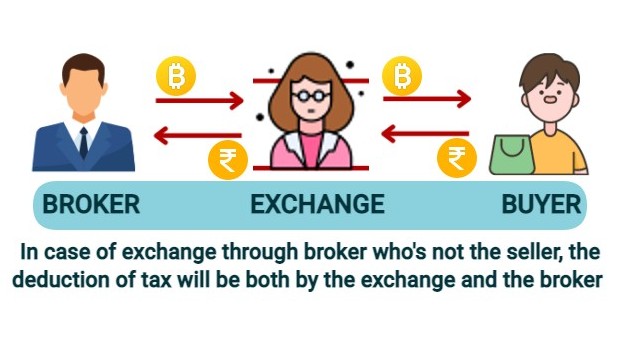

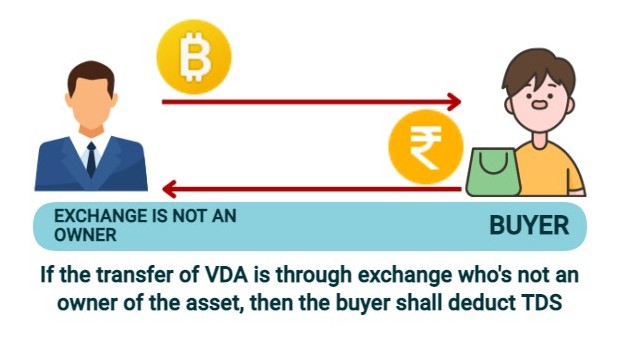

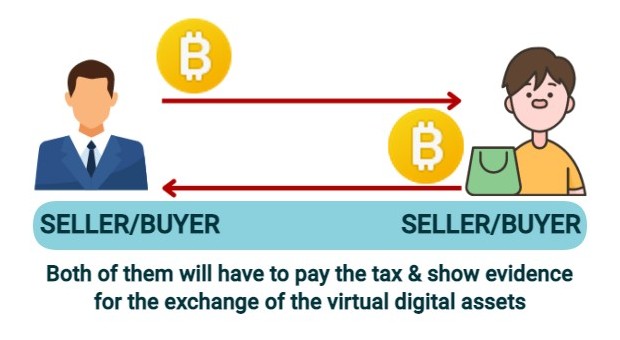

Section 194S was introduced in the Income Tax Act, 1961 just like Section 194R through the Finance Act, 2022. Thereby, as per Section 194S, there shall be a deduction of TDS @1% on the transfer of Virtual Digital Assets (VDA). Further, the provisions of this Section shall come into effect from July 1, 2022.