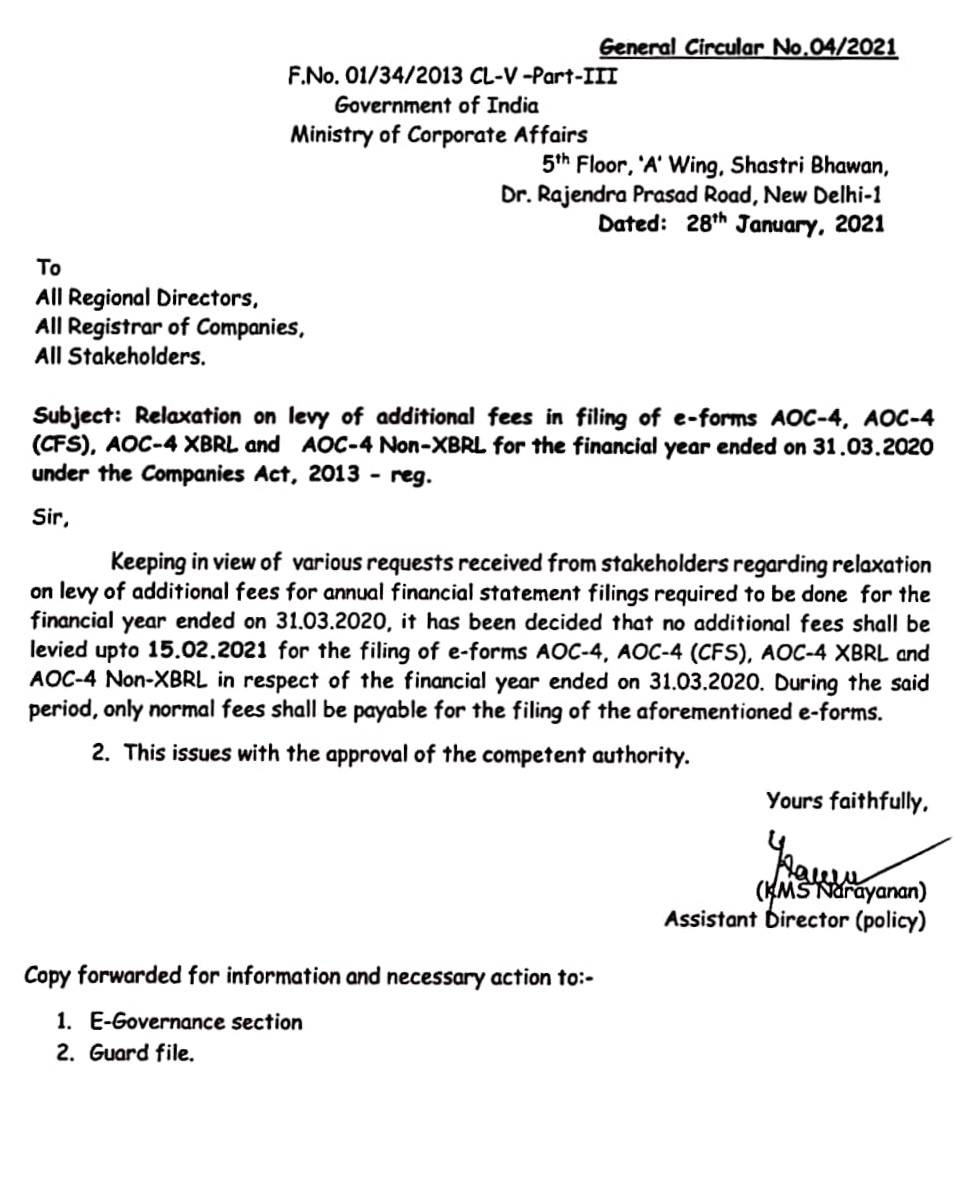

MCA Levies No Additional Fees For Filing of e-Forms AOC-4, AOC-4 (CFS), AOC-4 XBRL and AOC-4 Non-XBRL

MCA has announced that “No additional fees shall be levied upto 15.02.2021 for the filing of e-forms AOC-4, AOC-4 (CFS), AOC-4 XBRL and AOC-4 Non-XBRL in respect of the financial year ended on 31.03.2020”.

“During the said period, only normal fees shall be payable for the filing of the aforementioned e-forms.”

The official notification is stated below:

You might be interested in:

How to Register a Company/Startup in India

Have You Filed Your TDS Returns? Avoid Rs. 200/- per day Penalty!

Know The Difference Between Form 16, Form 16A, Form 16B

Whether Late Filing Fees (Interest u/s 234A) is Applicable For F.Y 2019-20?