RESET Option Enabled in GSTR 1/IFF on The GST Portal

The Goods and Services Tax Network(GSTN) has enabled the “RESET” option in GSTR 1/IFF on the GST portal.

For ready reference, the FAQs in regard to the ‘Reset” facility / function are given below:

- For which all months of a quarter will I be able to delete saved data using the RESET button?

You can use the RESET button to delete all the saved data for all the return periods, irrespective of your filing preference or profiles (monthly or quarterly taxpayers).

- I am not a quarterly profile taxpayer; will I still be able to view and click the RESET button to delete details?

Yes, the RESET button is available for all the taxpayer profile.

- I have submitted IFF details, will I still be able to delete the details using RESET button?

No, you cannot delete the submitted IFF details. The RESET button is used to delete only the saved details and not submitted or filed.

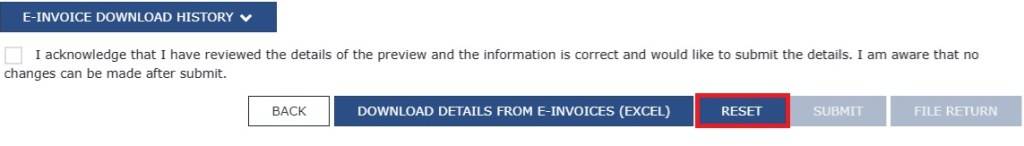

Note: The reset button can be used to delete only the saved details at one go and not submitted or filed. It may also be noted that while submitting the GSTR-1 / IFF, the taxpayer is required to acknowledge to have reviewed the details of the preview and to confirm that he is aware that no changes can be made after submit.

The official FAQ can be accessed at: https://tutorial.gst.gov.in/userguide/returns/FAQs_IFF.html

You might be interested in:

How To Change The Registered Mobile Number or Email ID on The GST Portal

All You Need To Know About Quarterly Return With Monthly Payment Scheme

ITR Rectification Enabled on The Portal For The AY 2020-21

Details of Different GST Return and Who Should File it ?

All You Need To Know About Quarterly Return With Monthly Payment Scheme