Taxability Of Dividend Income: Everything You Need To Know

The tax on dividend income was exempted for shareholders till the Assessment Year 2020-21. Therefore, the companies were liable to pay tax on such dividend income.

Taxability Of Dividend Income

The taxability of dividend income lies in the hands of companies as well as shareholders.

Before 31st March, 2020

Before 31st March, 2020

The taxability on dividend received from an Indian company was exempted until 31 March 2020 (FY 2019-20). This was because the company declaring such a dividend already paid dividend distribution tax (DDT) before making payment.

From 1st April, 2020 onwards

The exemption to the shareholders in respect of taxability of dividend income was withdrawn from Assessment Year 2021-20. Therefore, dividend received during the Financial Year 2020-21 and onwards is now be taxable in the hands of the shareholders.

👉 Read More: GST on Land & Building

Treatment Of Taxability Of Dividend Income

Taxability of dividend income depends upon whether the shareholder receiving dividend deals in it either as a trader or as an investor. If he earns dividend income by way of trading activities, then it is taxable under the head business income. Having stated that, if shares are held for trading purposes, then the dividend income shall be taxable under the head “Income from Business or Profession”. Whereas, if dividends are held for investment purposes, then dividend income shall be taxable under the head of “Income from Other Sources”.

Sources Of Dividend Income

The sources of dividend income can be from investment in:

- Shares of domestic company

- Shares of foreign company

- Equity mutual funds

- Debt mutual funds

Depending on the source of dividend income, relevant tax incidence would be applicable.

👉 Read About: GST ITC On Bank Charges – Everything to Know About

Classification Of Dividend Income On Basis Of Time And Taxability

The dividend income on the basis of time can be classified into interim dividend income and final dividend income.

An interim dividend income is taxable in the previous year in which the amount of such dividend is unconditionally made available by the company to the shareholder. In other words, an interim dividend is chargeable to tax on a receipt basis.

On the other hand, final dividend income including deemed dividend shall be taxable in the year in which it is declared, distributed or paid by the company, whichever is earlier.

👉 Read More: GST on Advance Income – Basics Explained

Deduction Of Expenses From Dividend Income

If the dividend income is assessable to tax as a business income, then the assessee can claim the deductions of all those expenditures which have been incurred to earn that dividend income. These expenditures could be such as collection charges, interest on loan etc.

Whereas if the dividend income is taxable under the head of income from other sources, the assessee can claim a deduction of only interest expenditure which has been incurred to earn that dividend income to the extent of 20% of total dividend income. No deduction shall be allowed for any other expenses including commission or remuneration paid to a banker or any other person for the purpose of realising such dividend.

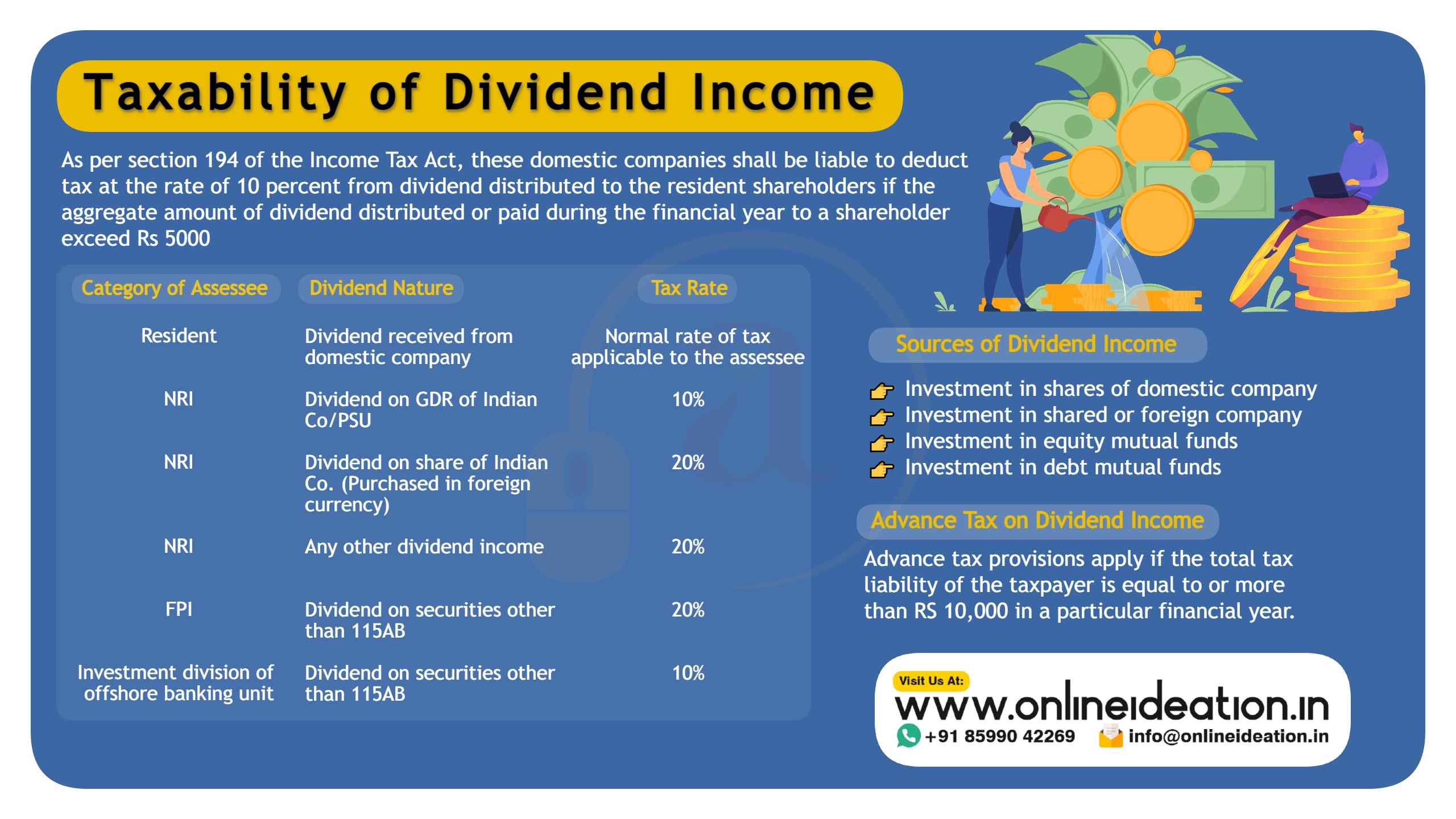

TDS On Dividend Income

As per Section 194, TDS shall be applicable to dividends distributed, declared or paid on or after 01-04-2020. Further, an Indian company shall deduct tax at the rate of 10% from dividend distributed to the resident shareholders, if the aggregate amount of dividend distributed or paid during the financial year to a shareholder exceeds Rs. 5,000.

Note

No tax shall be required to be deducted from the dividend paid or payable to Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC) or any other insurer in respect of any shares owned by it or in which it has full beneficial interest.

However, where the dividend is payable to a non-resident or a foreign company, the tax shall be deducted under Section 195 in accordance with relevant DTAA.

👉 Read About: ITC on Motor Vehicle – All You Need To Know

Rates Of TDS On Dividend Income

Rates of TDS on dividend income depends upon the type of assessee receiving dividend and the instrument on which dividend is distributed. This can be easily understandable via the following table:-

Category of Assessee | Dividend nature | Rate of Tax |

Resident | Dividend received from domestic company | Normal rate of tax applicable to the assessee |

NRI | Dividend on GDR of Indian co./PSU (purchased in foreign currency) | 10%

|

NRI | Dividend on shares of Indian co.(purchased in foreign currency) | 20%

|

NRI | Any other Dividend income | 20%

|

FPI | Dividend on securities other than 115AB | 20%

|

Investment Division of offshore banking unit | Dividend on securities other than 115AB | 10%

|

👉 Read About: Can You Claim HRA Even If You Own A House?

Advance Tax On Dividend Income

The provisions of advance tax apply, if the total tax liability of the taxpayer is equal to or more than Rs.10,000 in a particular financial year. Also, the interest and penalty are levied in case of non-payment or short payment of the advance tax liability.

Submission Of Form 15G/15H

A resident individual receiving dividend income and whose estimated annual income is below the exemption limit can submit form 15G to the company or mutual fund paying the dividend.

Similarly, a senior citizen whose estimated annual tax payable is nil can submit Form 15H to the company paying the dividend.

The company or mutual fund informs the shareholder about the dividend declaration on their registered mail id and requires submission of form 15G or form 15H to claim dividend income without TDS.

👉 Read About: Impact of ITC on Capital Goods

Double Taxation Relief On Dividend Income

Dividend income received from a foreign company gets taxed both in India and in the home country of the foreign company.

However, if the tax on an international company’s dividend has been paid twice (i.e. paid in both the countries), then the taxpayer can claim double taxation relief.

The relief claimed can be either as per the provisions of Double Taxation Avoidance Agreement (DTAA) entered into by the Government of India, with the country to which the foreign company belongs, or he can claim relief as per Section 91 (in case no such agreement exists). Through this, the taxpayer is n pay tax on the same income twice.

For Income Tax Return Filing Services

👉 Book Service 👈

DISCLAIMER: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site doesn’t constitute legal or professional advice. It should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.